AGEM Index slips 5 mths in row, down 9pct December

Jan 11, 2019 Newsdesk Industry Talk, Latest News, World

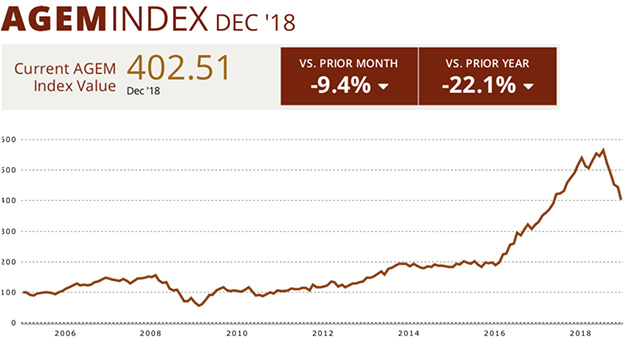

The monthly AGEM Index of prices of shares in 14 important international suppliers of gaming machines declined last month to 402.51 points, 41.73 points or 9.4 percent less than the month before. Compared to December 2017, the index contracted by 22.1 percent.

The Association of Gaming Equipment Manufacturers (AGEM), which compiles the index, issued a written statement containing a table showing that the prices of three of the stocks it tracks rose last month and share prices of the index’s remaining 11 constituents fell – with seven of those companies enduring a double-digit decline.

A fall in the share price of Aristocrat Leisure Ltd of Australia, a 6.7-percent decline in December, subtracted 16.23 points from the AGEM Index. The price of shares in Crane Co of the United States fell by 16.4 percent, subtracting a further 11.7 points from the index.

More broadly, the association said the contraction in the index reflected last month’s declines in the main gauges of stock prices in the United States, where most of the stocks tracked by the index are traded. The Dow Jones Industrial Average dropped by 8.7 percent, the S&P 500 index by 9.2 percent and the Nasdaq index by 9.5 percent in December.

Some 10 suppliers are included in the index are based in the U.S., two constituent stocks are listed on the Australian Securities Exchange, one is traded in Tokyo, and another trades on the Taipei Exchange, Taiwan’s over-the-counter market for stocks and bonds.

The decline in last month’s index continues a recent trend of contraction. The index endured month-on-month declines of 7.76 percent in August; 5.46 percent in September; and 8.29 percent in October.

The association began compiling data for the index in January 2005 using a base of 100 points.

The stocks that constitute the AGEM Index are weighted by approximate market capitalisation. AGEM represents the manufacturers of electronic gaming devices, systems, lotteries and components for the gaming industry.

Related articles

-

Aristocrat, L&W stocks lead AGEM...

Aristocrat, L&W stocks lead AGEM...Jul 04, 2024

-

Aristocrat targets US$1bln revenue from...

Aristocrat targets US$1bln revenue from...Jun 27, 2024

More news

-

Donaco EBITDA up y-o-y to above US$4mln...

Donaco EBITDA up y-o-y to above US$4mln...Jul 26, 2024

-

HK listed Palasino upgrades Czech...

HK listed Palasino upgrades Czech...Jul 26, 2024

Latest News

Jul 26, 2024

Border-casino operator Donaco International Ltd has achieved a 164.17-percent year-on-year increase in its latest quarterly group earnings before interest, taxation, depreciation and amortisation...Sign up to our FREE Newsletter

(Click here for more)

(Click here for more)

Pick of the Day

”We’ve got more traction outside of Macau at the moment. But Macau’s going be a bigger focus for us”

David Punter

Regional representative at Konami Australia

Most Popular

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024  Macau regulator probes unlicensed gaming agents July 24, 2024

Macau regulator probes unlicensed gaming agents July 24, 2024  Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024

Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024  Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024

Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024  Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024

Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024