AGEM Index treads water in Jan 2015

Feb 06, 2015 Newsdesk Industry Talk, Latest News, Top of the deck

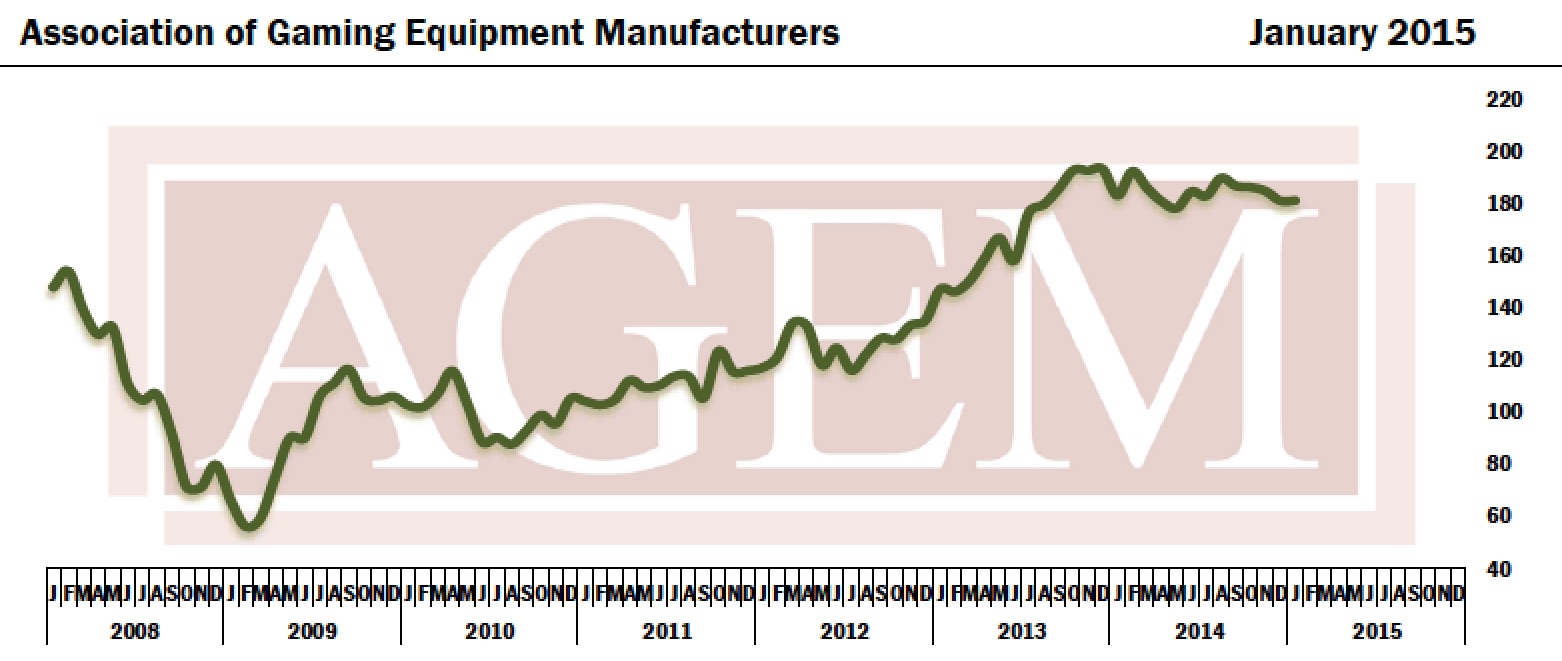

The AGEM Index was flat in the first month of 2015 in comparison with December. The index moved from a composite score of 181.84 to one of 181.89, said the Association of Gaming Equipment Manufacturers (AGEM) and research firm Applied Analysis LLC. They jointly compile the index.

But it is the first month since August 2014 that the AGEM Index has not reported a month-to-month decline.

Judged on a year-on-year basis, the index fell 1.96 points, or 1.1 percent. The AGEM Index has now reported year-over-year declines for four consecutive months.

According to Thursday’s report, half of the 14 global gaming equipment suppliers reported month-to-month gains in stock price, with two of them up by more than 20 percent. The gains however were offset by the remaining seven suppliers, with four reporting declines of more than 5 percent in their stock price.

Two Australia-based gaming equipment manufacturers – Aristocrat Leisure Ltd and Ainsworth Game Technology Ltd – were among the positive contributors to last month’s AGEM Index. Ainsworth contributed 1.37 points, due to a 25.0-percent increase in stock price, while Aristocrat contributed 1.10 points.

Mergers in the industry seem to be having an impact on stock prices. Italy-based GTech SpA had a negative contribution by 2.97 points, due to a 5.9-percent decline in its stock price; while International Game Technology (IGT) saw its stock price go down by 1.9 percent in January, creating a negative contribution to the index amounting to 0.71 points.

Shareholders of IGT are due to vote next Tuesday on a proposed US$6.4-billion merger with lottery equipment and management specialist GTech SpA.

Scientific Games Corp, which in late November completed the US$5.1 billion acquisition of Bally Technologies Inc, reported a stock price of US$11.81 in January, down 7.2 percent, and contributed a negative of 0.64 points.

The AGEM Index is computed based on the month-end stock price (adjusted for dividends and splits) of each company and weighted based on approximation of market capitalisation. It is based on a 100-point value recorded as of January 2005.

Of the 14 gaming suppliers included in the index, nine are publicly-listed in the United States, while two trade on the main Australian exchange. One supplier trades on the Athens exchange in Greece, one trades on the Milan exchange in Italy, and another trades on the Taiwan OTC exchange.

Related articles

-

Aristocrat, L&W stocks lead AGEM...

Aristocrat, L&W stocks lead AGEM...Jul 04, 2024

-

Aristocrat targets US$1bln revenue from...

Aristocrat targets US$1bln revenue from...Jun 27, 2024

More news

-

Donaco EBITDA up y-o-y to above US$4mln...

Donaco EBITDA up y-o-y to above US$4mln...Jul 26, 2024

-

HK listed Palasino upgrades Czech...

HK listed Palasino upgrades Czech...Jul 26, 2024

Latest News

Jul 26, 2024

Border-casino operator Donaco International Ltd has achieved a 164.17-percent year-on-year increase in its latest quarterly group earnings before interest, taxation, depreciation and amortisation...Sign up to our FREE Newsletter

(Click here for more)

(Click here for more)

Pick of the Day

”We’ve got more traction outside of Macau at the moment. But Macau’s going be a bigger focus for us”

David Punter

Regional representative at Konami Australia

Most Popular

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024  Macau regulator probes unlicensed gaming agents July 24, 2024

Macau regulator probes unlicensed gaming agents July 24, 2024  Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024

Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024  Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024

Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024  Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024

Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024