Aristocrat, Konami help AGEM Index jump 13 pct in May

Jun 10, 2016 Newsdesk Industry Talk, Latest News

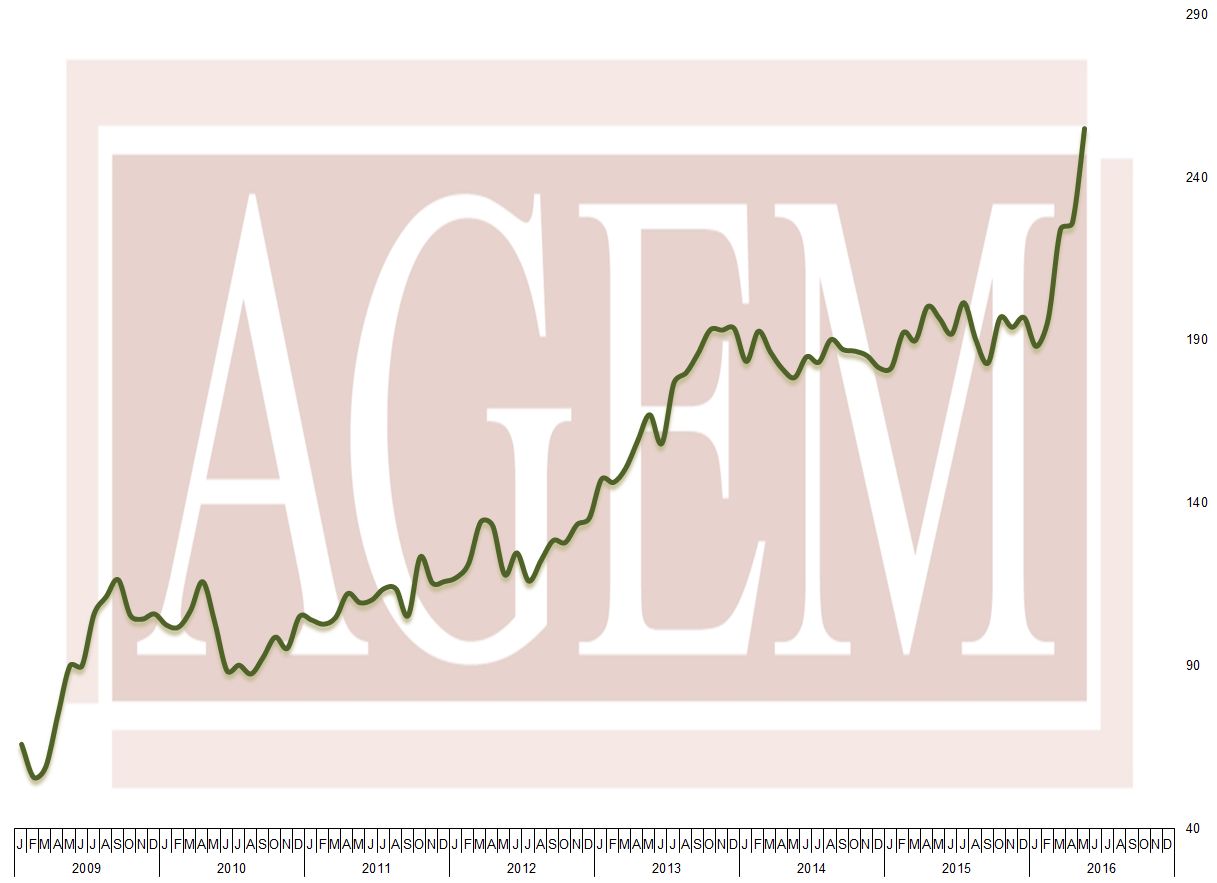

The AGEM Index, which tracks the stock performance of the world’s major listed casino gaming equipment suppliers, posted a 12.7-percent month-on-month increase in May.

The composite index increased by 28.83 points from April, to end May at 255.34 points.

This was the index’s fourth consecutive month-on-month gain.

The AGEM Index also reported a year-on-year increase for the eighth consecutive month, rising 58.36 points, or 29.6 percent, when compared to May 2015.

Last month, 10 of the 14 global gaming equipment manufacturers tracked by the index reported monthly gains in stock price, with two up by more than 10 percent. Australia-based slot machine maker Aristocrat Leisure Ltd reported a share price increase of 28.6 percent in May, while large-cap Japan-listed Konami Corp posted a 22.3 percent increase for the period.

U.S.-based International Game Technology Plc also reported a strong stock performance in May: the price of its shares rose by 9.3 percent in month-on-month terms.

In the opposite direction, Everi Holdings Inc – a specialist in cash handling technology – saw its stock price decline by nearly 14.9 percent month-on-month. Slot machine printer specialist TransAct Technologies Inc also recorded a share price loss of almost 15 percent for the period.

The Association of Gaming Equipment Manufacturers (AGEM) produces the monthly AGEM Index, in association with research firm Applied Analysis LLC. The index is computed based on the month-end stock price (adjusted for dividends and splits) of each company and weighted based on approximation of market capitalisation. It is based on a 100-point value recorded as of January 2005.

AGEM is a non-profit international trade association representing manufacturers and suppliers of electronic gaming devices, systems, table games, online technology, key components, and support products and services for the gaming industry.

Related articles

-

HK listed Palasino upgrades Czech...

HK listed Palasino upgrades Czech...Jul 26, 2024

-

Spintec eyes growth in Australia as...

Spintec eyes growth in Australia as...Jul 18, 2024

More news

-

Donaco EBITDA up y-o-y to above US$4mln...

Donaco EBITDA up y-o-y to above US$4mln...Jul 26, 2024

-

China embassy in Manila welcomes POGO...

China embassy in Manila welcomes POGO...Jul 26, 2024

Latest News

Jul 26, 2024

Border-casino operator Donaco International Ltd has achieved a 164.17-percent year-on-year increase in its latest quarterly group earnings before interest, taxation, depreciation and amortisation...Sign up to our FREE Newsletter

(Click here for more)

(Click here for more)

Pick of the Day

”We’ve got more traction outside of Macau at the moment. But Macau’s going be a bigger focus for us”

David Punter

Regional representative at Konami Australia

Most Popular

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024  Macau regulator probes unlicensed gaming agents July 24, 2024

Macau regulator probes unlicensed gaming agents July 24, 2024  Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024

Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024  Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024

Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024  Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024

Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024