Aristocrat Leisure, Konami rein in September AGEM Index

Oct 09, 2018 Newsdesk Industry Talk, Latest News, Top of the deck, World

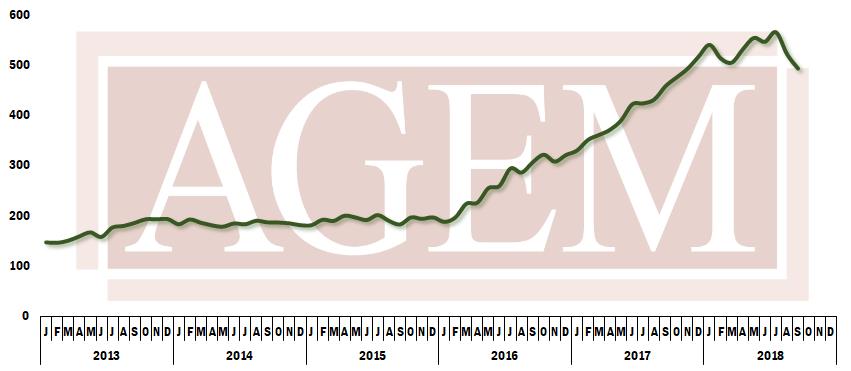

The AGEM Index of the prices of shares in makers of gaming equipment fell last month to 493.03 points, a decline of 28.48 points – or 5.46 percent – compared to the month before. The Association of Gaming Equipment Manufacturers (AGEM), which compiles the index, said in a written statement that the index last month was 7.67 percent higher than a year earlier, showing an annual increase for the 36th month in a row.

There were increases in six of the 13 stocks of gaming equipment manufacturers around the world that the index tracks. Among the stocks that rose were Crane Co, which added 7.12 points to the index by gaining 7.75 percent, and Everi Holdings Inc, which added 0.58 point to the index by gaining 5.77 percent.

Among the stocks that fell were Aristocrat Leisure Ltd, which subtracted 19.9 points from the index by losing 9.97 percent, and Konami Corp., which subtracted 5.52 points from the index by losing 4.4 percent.

Two of the three main stock market gauges rose last month, the S&P 500 index rising by 0.43 percent to 2,913.98 points and the Dow Jones Industrial Average rising by 1.9 percent to 26,458.31 points, while the NASDAQ Composite Index fell by 0.78 percent.

AGEM compiles the AGEM Index in association with Applied Analysis LLC. The index tracks the price of each of the component stocks at the end of each calendar month, adjusted for dividends and splits and weighted according to the approximate market capitalisation of each company.

The base the index is 100 points, set in January 2005.

Related articles

-

Spintec eyes growth in Australia as...

Spintec eyes growth in Australia as...Jul 18, 2024

-

Star Ent shuts down EGMs, ETGs in all...

Star Ent shuts down EGMs, ETGs in all...Jul 15, 2024

More news

-

Donaco EBITDA up y-o-y to above US$4mln...

Donaco EBITDA up y-o-y to above US$4mln...Jul 26, 2024

-

HK listed Palasino upgrades Czech...

HK listed Palasino upgrades Czech...Jul 26, 2024

Latest News

Jul 26, 2024

Border-casino operator Donaco International Ltd has achieved a 164.17-percent year-on-year increase in its latest quarterly group earnings before interest, taxation, depreciation and amortisation...Sign up to our FREE Newsletter

(Click here for more)

(Click here for more)

Pick of the Day

”We’ve got more traction outside of Macau at the moment. But Macau’s going be a bigger focus for us”

David Punter

Regional representative at Konami Australia

Most Popular

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024  Macau regulator probes unlicensed gaming agents July 24, 2024

Macau regulator probes unlicensed gaming agents July 24, 2024  Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024

Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024  Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024

Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024  Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024

Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024