Brokerages concerned with GEN Singapore’s bad debt level

Aug 05, 2019 Newsdesk Latest News, Singapore, Top of the deck

The significant increase in bad debt reported by Genting Singapore Ltd in the three months to June 30 “dragged” on the firm’s earnings, representing a “negative surprise” and hinting to a loosening credit policy, according to separate notes from three brokerages.

Genting Singapore reported on Friday second-quarter net profit of SGD168.4 million (US$122.3 million), down 5.2 percent from the prior-year period. That was despite a 13.6-percent increase in revenue in year-on-year terms, boosted by an increase in gaming revenue, largely driven by a high VIP hold rate during the period.

The company said that on a hold-normalised basis, the group’s adjusted earnings before interest, taxation, depreciation and amortisation (EBITDA) would have declined by 20 percent year-on-year.

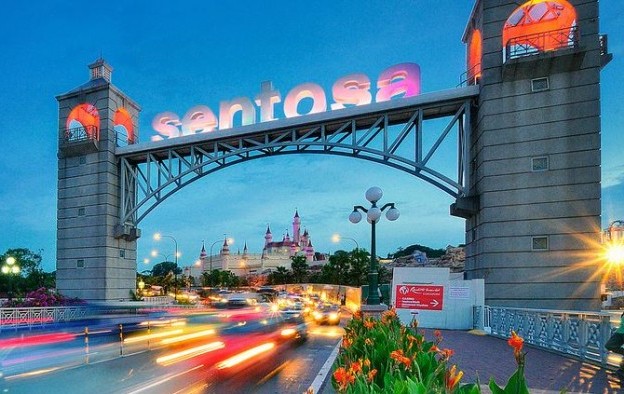

Genting Singapore is the operator of Singapore casino complex Resorts World Sentosa (pictured).

“Despite high VIP hold (3.7 percent versus historical average hold rate for Singapore VIP gaming of 2.85 percent), poor mass performance and high bad debt expense dragged [Genting Singapore’s] EBITDA numbers,” said Sanford C. Bernstein Ltd in a Friday note.

Although Genting Singapore’s management talked – during a conference call with analysts following the second-quarter results announcement – about exercising a prudent credit extension policy, the brokerage said it remained “concerned” over the casino operator’s level of bad debt expense.

Genting Singapore reported an impairment loss on trade receivables – including credit extended to VIP players but not paid back – of SGD47.3 million for the second quarter, compared to SGD479,000 a year earlier.

Sanford Bernstein said Genting Singapore’s second-quarter trade receivables were “back to levels” previously seen in 2016. “Bad debt expense as a percentage of accounts receivable is also a staggering 31 percent,” wrote analysts Vitaly Umansky, Eunice Lee and Kelsey Zhu.

In its second-quarter earnings, Genting Singapore’s management said it maintained a “cautious stance” over the regional economic development and especially its impact on the premium gaming segment.

Japanese brokerage Nomura said in a Friday memo that Genting Singapore’s second-quarter high impairment charge was a “negative surprise” and “unexpected”.

“But [Genting Singapore’s] management attributed it to their prudent stance in providing for future losses given the escalation in macro uncertainty,” said analysts Tushar Mohata and Alpa Aggarwal. “We believe this will not be annualised for the rest of 2019.”

The Nomura team said also it was trimming its forecast for Genting Singapore’s adjusted EBITDA for fiscal years 2019 and 2020 respectively by 2 percent and 4 percent. The analysts said the new forecast was to “build in the decline in mass volumes and also pencil in a higher accelerated depreciation charge to factor in an earlier end to the useful life of some assets”.

Maybank Investment Bank Bhd stated in a Sunday memo that Genting Singapore’s fundamentals “continue to weaken”, noting that the company’s second-quarter impairment of trade receivables “was the highest since the third quarter 2016”.

“More crucially, the high margin second-quarter 2019 mass-market gross gaming revenue (GGR) fell [circa] 3 percent year-on-year and [circa] 10 percent quarter-on-quarter due to the Singaporean citizens and permanent residents casino entry levy hike of 50 percent that came into effect on April 4, 2019,” wrote analyst Samuel Yin Shao Yang.

The Singaporean government said in April it had agreed to the expansion of the city’s two integrated casino resorts in return for an aggregate investment of SGD9 billion. As part of the deal, the Singaporean authorities also announced an increase to taxes and to casino entry levies for locals.

Maybank’s Mr Yin quoted Genting Singapore’s management as saying that Resorts World Sentosa’s mass market business would “need time to stabilise” following the changes announced in April.

Related articles

-

MBS Tower 3 rooms revamp now by 2Q...

MBS Tower 3 rooms revamp now by 2Q...Jul 25, 2024

-

Sands China 2Q EBITDA down q-o-q amid...

Sands China 2Q EBITDA down q-o-q amid...Jul 25, 2024

More news

-

Donaco EBITDA up y-o-y to above US$4mln...

Donaco EBITDA up y-o-y to above US$4mln...Jul 26, 2024

-

HK listed Palasino upgrades Czech...

HK listed Palasino upgrades Czech...Jul 26, 2024

Latest News

Jul 26, 2024

Border-casino operator Donaco International Ltd has achieved a 164.17-percent year-on-year increase in its latest quarterly group earnings before interest, taxation, depreciation and amortisation...Sign up to our FREE Newsletter

(Click here for more)

(Click here for more)

Pick of the Day

”We’ve got more traction outside of Macau at the moment. But Macau’s going be a bigger focus for us”

David Punter

Regional representative at Konami Australia

Most Popular

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024  Macau regulator probes unlicensed gaming agents July 24, 2024

Macau regulator probes unlicensed gaming agents July 24, 2024  Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024

Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024  Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024

Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024  Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024

Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024