CBRE involved in funding work for Nagasaki IR: reports

Apr 14, 2022 Newsdesk Japan, Latest News, Top of the deck

CBRE Group Inc, an American commercial real estate services and investment firm, would have some involvement in the funding arrangements for a slated JPY438.3-billion (US$3.5-billion) casino resort in Japan’s Nagasaki prefecture, reported several of the country’s media outlets, citing plan documents submitted on Tuesday to Sasebo city council.

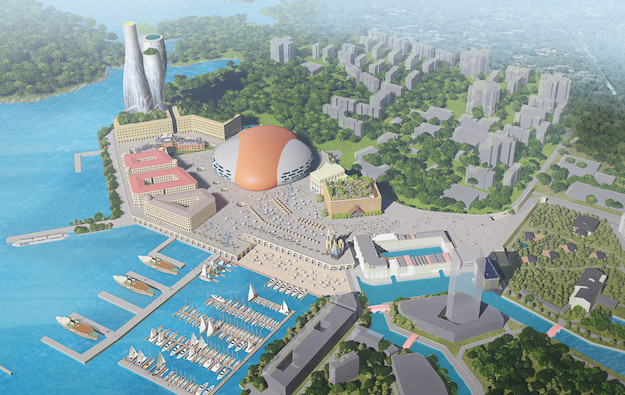

The integrated resort (IR) project (pictured in an artist’s rendering) would be located at the Huis Ten Bosch theme park in Sasebo City, part of Nagasaki prefecture.

On Tuesday, Sasebo’s city council held a steering committee to discuss the project, pending an expected submission by the Nagasaki authorities of the scheme to the national government by the end of April.

The so-called IR district development plan is also due to be debated by an extraordinary session of Nagasaki prefectural assembly, before being submitted to the national authorities.

According to information collated by GGRAsia’s Japan correspondent, the details of the funding providers are yet to be announced.

Previously-disclosed information said that the equity portion would be JPY175.3 billion, with 60 percent of the equity from Nagasaki’s private-sector partner, Casinos Austria International Japan Inc, 30 percent from other foreign companies, and 10 percent from Japanese companies.

Up to three casino resorts will be permitted in Japan, under the liberalisation arrangements. Currently, Osaka and Wakayama are also likely to submit applications.

Related articles

-

Ex lead official on IR push named Japan...

Ex lead official on IR push named Japan...Jul 08, 2024

-

Hokkaido assembly LDP reps show...

Hokkaido assembly LDP reps show...Jun 25, 2024

More news

-

Donaco EBITDA up y-o-y to above US$4mln...

Donaco EBITDA up y-o-y to above US$4mln...Jul 26, 2024

-

HK listed Palasino upgrades Czech...

HK listed Palasino upgrades Czech...Jul 26, 2024

Latest News

Jul 26, 2024

Border-casino operator Donaco International Ltd has achieved a 164.17-percent year-on-year increase in its latest quarterly group earnings before interest, taxation, depreciation and amortisation...Sign up to our FREE Newsletter

(Click here for more)

(Click here for more)

Pick of the Day

”We’ve got more traction outside of Macau at the moment. But Macau’s going be a bigger focus for us”

David Punter

Regional representative at Konami Australia

Most Popular

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024  Macau regulator probes unlicensed gaming agents July 24, 2024

Macau regulator probes unlicensed gaming agents July 24, 2024  Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024

Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024  Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024

Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024  Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024

Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024