Gaming supplier index ends 2015 in positive territory

Jan 08, 2016 Newsdesk Industry Talk, Latest News, Top of the deck

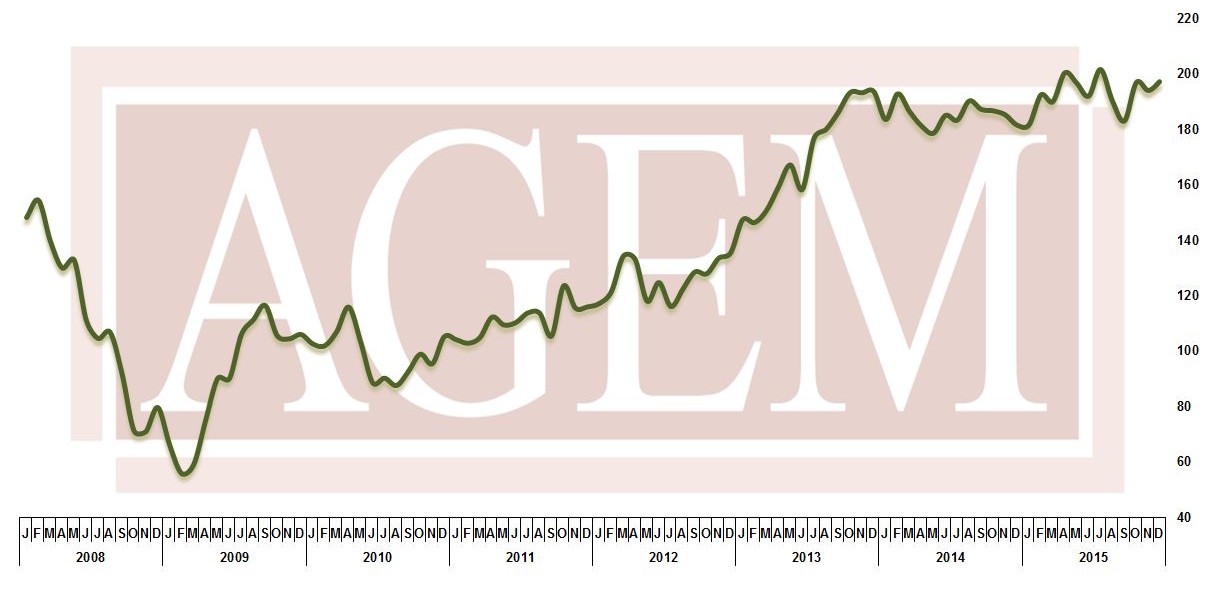

The AGEM Index ended 2015 with a positive performance. The index, which tracks stock prices of listed firms in the casino equipment supply sector, closed the year at 197.32 points, an increase of 8.5 percent compared to 2014.

However, only five of the 14 global gaming equipment manufacturers covered by the index reported a positive stock price performance for 2015.

Nasdaq-listed TransAct Technologies Inc, a supplier of ticket printers for the gaming industry, was the AGEM Index’s best performer by share price. It reported a hike of 57.0 percent in its stock price in 2015, said the Association of Gaming Equipment Manufacturers (AGEM). It compiles the index in association with research firm Applied Analysis LLC.

AGEM is a non-profit international trade association representing manufacturers and suppliers of electronic gaming devices, systems, table games, online technology, key components and support products and services for the gaming industry.

The AGEM Index is computed based on the month-end stock price (adjusted for dividends and splits) of each company and weighted based on approximation of market capitalisation. It is based on a 100-point value recorded as of January 2005.

Australia-listed slot machine supplier Aristocrat Leisure Ltd was in second place among the AGEM Index stock price gainers. It posted an annual increase of 55.6 percent in its share price for 2015, according to AGEM.

Other stock price gainers in 2015 included Konami Holdings Corp (+30.1 percent), Intralot SA (+7.3 percent) and Gaming Partners International Corp (+4.1 percent).

Galaxy Gaming Inc, a manufacturer of casino table game products with shares traded in the United States, led the AGEM Index in terms of stock price losses in 2015. The company posted a decline in share price of 51.3 percent for the year.

Astro Corp (-40.3 percent), Everi Holdings Inc – formerly Global Cash Access Holdings Inc – (-38.6 percent) and Scientific Games Corp (-29.5 percent) followed in the 2015 rankings in terms of being the worst performing companies on the AGEM Index.

In December, the index went up by 1.5 percent month-on-month.

Rise of skill-based gaming

Regarding the supplier sector’s prospects for 2016, AGEM said it expected skill-based games to become more conspicuous on casino floors, especially in the United States, where some states have already approved regulations for what – for most jurisdictions – is a new product segment.

In standard casino slot machines, the distribution of the calibrated return to player (RTP) – the percentage of all the wagered money a slot machine will pay back to players over time – is based purely on outcomes generated by a random number generator. In skill-based slot games, a player’s skill can have a material effect on the outcome of the game, offering opportunities for players to progress in difficulty levels and even influencing the game’s payouts.

In addition, skill-based games can offer community or group play where multiple players can engage simultaneously, adding a social aspect to the gaming experience. Such game elements are likely to attract younger gamblers, suggest some industry consultants.

Skill-based gaming has not so far been widely discussed in the Asia-Pacific casino market.

“Despite the potential draw surrounding these new game types, questions still remain in terms of their profitability from the casino’s perspective given limited history,” noted AGEM.

It added: “While skill-based games are still in their infancy, they offer a bright and daring future for the slot machine industry. With casinos beginning to experiment with the new products on their floors and the necessary legislation in place, players can expect to see these games arriving in 2016.”

Related articles

-

Spintec eyes growth in Australia as...

Spintec eyes growth in Australia as...Jul 18, 2024

-

Star Ent shuts down EGMs, ETGs in all...

Star Ent shuts down EGMs, ETGs in all...Jul 15, 2024

More news

-

Donaco EBITDA up y-o-y to above US$4mln...

Donaco EBITDA up y-o-y to above US$4mln...Jul 26, 2024

-

HK listed Palasino upgrades Czech...

HK listed Palasino upgrades Czech...Jul 26, 2024

Latest News

Jul 26, 2024

Border-casino operator Donaco International Ltd has achieved a 164.17-percent year-on-year increase in its latest quarterly group earnings before interest, taxation, depreciation and amortisation...Sign up to our FREE Newsletter

(Click here for more)

(Click here for more)

Pick of the Day

”We’ve got more traction outside of Macau at the moment. But Macau’s going be a bigger focus for us”

David Punter

Regional representative at Konami Australia

Most Popular

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024  Macau regulator probes unlicensed gaming agents July 24, 2024

Macau regulator probes unlicensed gaming agents July 24, 2024  Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024

Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024  Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024

Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024  Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024

Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024