GEN Malaysia 1Q net profit up despite VIP weakness

May 29, 2015 Newsdesk Latest News, Rest of Asia, Top of the deck

Casino operator Genting Malaysia Bhd on Thursday reported a 1.06 percent year-on-year rise in its unaudited profit attributable to shareholders for the three months to March 31. Such profit rose to MYR362.1 million (US$99.2 million) from approximately MYR358.3 million in the year-prior period.

The firm, an operator of casino properties in Malaysia, the United States, the Bahamas and the United Kingdom, said the increase was partly driven “by a one-off gain arising from a waiver of debt” amounting to MYR28.7 million. It didn’t give further details on the waiver.

The company reported a 3 percent growth in revenue to MYR2.09 billion in the first quarter of 2015, up from MYR2.03 billion in the prior-year period.

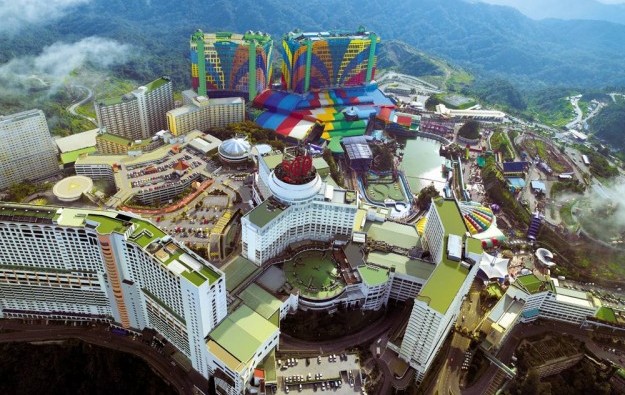

The firm added that its Malaysian operations, including its flagship Resorts World Genting property (pictured), contributed MYR1.39 billion in revenue in the period, up by 2 percent from a year earlier. It said the growth was “primarily due to an overall higher volume of business despite lower hold percentage in the premium players business”.

Genting Malaysia said in its quarterly results filed with Bursa Malaysia: “The outlook for international tourism in 2015 is expected to be encouraging, with growing demand albeit at a slower rate.”

But the firm added: “In Malaysia, economic activities are likely to moderate in view of the fiscal measures undertaken this year.”

Lim Tee Yang, an analyst at Affin Hwang Investment Bank Bhd, a unit of Daiwa Securities Co Ltd, said in a note: “Genting Malaysia’s first quarter 2015 results were within expectations. The domestic operations have remained resilient so far but the litmus test would be in the second quarter of 2015 when the impact of the GST [Goods and Services Tax] can be observed on casino patrons and Genting Malaysia’s margins.”

Malaysia implemented a 6-percent Goods and Services Tax on most consumer items – including gaming – on April 1.

In Malaysia, the company’s margin on adjusted earnings before interest, taxation, depreciation and amortisation (EBITDA) was lower at 35 percent compared to 37 percent last year. Higher payroll costs and costs relating to premium players business impacted the adjusted EBITDA margin, the operator said.

In the United Kingdom, Genting Malaysia’s revenue decreased by 7 percent year-on-year to MYR355.7 million. That was because of a “lower hold percentage and volume of business” in the international markets division mainly related to VIP players, the firm said.

Revenue from operations in the United States, which for accounting purposes includes Resorts World Bimini in the Bahamas, improved by 22 percent to MYR313.8 million, “largely contributed by higher volumes of business from the Resorts World Casino New York City and Bimini operations,” the company added.

Genting Malaysia – part of the Genting Bhd conglomerate that invests globally in casinos – said the global economic growth is expected to remain moderate with uneven prospects across major economies.

“Regional gaming operators in Macau and Singapore continue to see a slowdown in gaming revenues as the Asian premium players market remains challenging,” it added.

Samuel Yin Shao Yang, of Maybank IB Research, said in a note on the results of Genting Malaysia’s parent company that the bank continued to prefer the Malaysia unit over the parent “for its more stable operations and MYR5 billion Genting Integrated Tourism Plan at Resorts World Genting that will raise room inventory by around 35 percent by 2018″.

Genting Malaysia said a fortnight ago it was seeking to raise at least US$472.2 million from a proposed sale of its entire 17.81 percent interest in casino ship operator and Philippines casino investor Genting Hong Kong Ltd. The firm said some of the money raised might be used in the redevelopment of Resorts World Genting.

Genting Bhd on Thursday posted a 24.6 percent year-on-year rise in first-quarter net profit, to MYR620 million. The parent company also controls Genting Singapore Plc, which on May 14 posted a 73-percent decline in net profit for the first quarter of 2015, due to weakness in the VIP gaming market.

Related articles

-

GEN Malaysia unit early redemption on...

GEN Malaysia unit early redemption on...Jul 11, 2024

-

New Hoiana CFO is former Resorts World...

New Hoiana CFO is former Resorts World...Jul 08, 2024

More news

-

Donaco EBITDA up y-o-y to above US$4mln...

Donaco EBITDA up y-o-y to above US$4mln...Jul 26, 2024

-

HK listed Palasino upgrades Czech...

HK listed Palasino upgrades Czech...Jul 26, 2024

Latest News

Jul 26, 2024

Border-casino operator Donaco International Ltd has achieved a 164.17-percent year-on-year increase in its latest quarterly group earnings before interest, taxation, depreciation and amortisation...Sign up to our FREE Newsletter

(Click here for more)

(Click here for more)

Pick of the Day

”We’ve got more traction outside of Macau at the moment. But Macau’s going be a bigger focus for us”

David Punter

Regional representative at Konami Australia

Most Popular

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024  Macau regulator probes unlicensed gaming agents July 24, 2024

Macau regulator probes unlicensed gaming agents July 24, 2024  Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024

Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024  Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024

Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024  Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024

Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024