GEN Malaysia shareholders nod sale of Genting HK stake

Jul 03, 2015 Newsdesk Latest News, Rest of Asia, Singapore, Top of the deck

Shareholders of casino operator Genting Malaysia Bhd approved on Thursday a mandate to sell the company’s entire 17.81 percent interest in casino ship operator and Philippines casino investor Genting Hong Kong Ltd. Genting Malaysia expects to raise at least US$472.2 million gross from the proposed sale.

A total of 75.84 percent of the shareholders that attended the extraordinary general meeting on Thursday voted in favour of the plan, according to a filing to Bursa Malaysia.

The minimum estimated gross from the exercise assumes disposal of all the 1,431,059,180 Genting Hong Kong shares held by Resorts World Ltd – an indirect wholly owned subsidiary of Genting Malaysia – at a minimum disposal price of US$0.33 per share, the firm said in a filing in June.

Disposal at the minimum price would however represent a loss to Genting Malaysia, which paid US$604.1million for its Genting Hong Kong stake, at an average purchase price of US$0.42 per share, between 1998 and 2006, according to June’s filing.

The firm had said the shares in Genting Hong Kong are considered non-core investments and are treated as “available-for sale financial assets”.

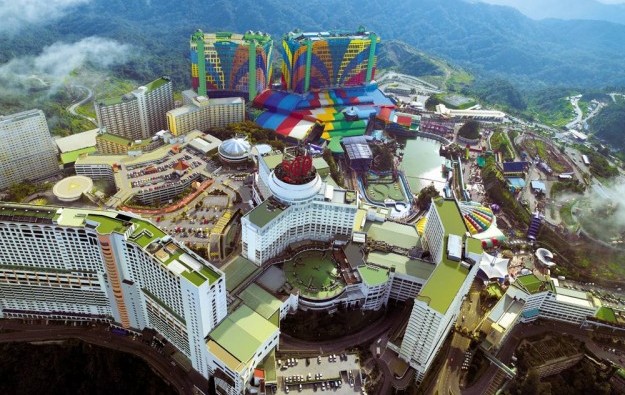

Genting Malaysia, a unit of Malaysia-based conglomerate Genting Bhd, said it would use the money raised to pursue other core investments and for the redevelopment of Resorts World Genting (pictured), the firm’s Malaysian casino and entertainment venue. It is spending MYR5 billion (US$1.3 billion) over 10 years, to revamp the resort as part if its ‘Genting Integrated Tourism Plan’.

In a separate development, Fitch Ratings Inc on Thursday maintained the long-term rating of Genting Malaysia’s parent, Genting Bhd, at ‘A-’, with a stable outlook. It also reaffirmed the ‘A-’ rating to another of Genting Bhd’s subsidiaries, Genting Singapore Plc.

Genting Singapore developed and operates Resorts World Sentosa in Singapore and in February broke ground on its US$1.8-billion casino resort in South Korea’s Jeju Island.

“Genting’s [Genting Bhd] ratings reflect its continued strong market position in the Malaysian and Singaporean gaming markets and meaningful diversification in the plantations and energy sectors. The ratings also reflect the company’s conservative financial policies,” Fitch said.

“Genting Singapore’s ratings are equalised with Genting’s [Bhd] due to the strong strategic and operational ties between the two entities,” the ratings agency added.

While Genting Bhd’s gaming profitability margins have fallen, “overall profitability is consistent with its rating,” Fitch said.

But it warned that Genting Singapore faces multiple pressures. “Tourist arrivals to Singapore between January and April 2015 were 5.4 percent lower than the same period last year due to the macroeconomic slowdown and anti-corruption crackdown in China, along with the depreciating Indonesian rupiah and the uncertainty in global markets,” the rating agency said. “The VIP market has accounted for almost 50 percent of Singapore’s GGR [gross gaming revenue] thus far.”

With the declining trend in tourist inflows since the second half of 2014, Fitch said it expects the Singapore operation’s GGR “to either stagnate or shrink slightly”.

Fitch additionally said that if Singapore’s government grants additional licences when the 10-year exclusivity period on the current two licences expires in 2017, Genting Singapore’s “market position, scale and profitability would weaken”.

In May, Singapore’s Senior Minister of State for Trade and Industry Lee Yi Shyan told the city-state’s parliament that the government had “no plans” to grant additional casino licences.

Related articles

-

GEN Malaysia unit early redemption on...

GEN Malaysia unit early redemption on...Jul 11, 2024

-

New Hoiana CFO is former Resorts World...

New Hoiana CFO is former Resorts World...Jul 08, 2024

More news

-

Donaco EBITDA up y-o-y to above US$4mln...

Donaco EBITDA up y-o-y to above US$4mln...Jul 26, 2024

-

HK listed Palasino upgrades Czech...

HK listed Palasino upgrades Czech...Jul 26, 2024

Latest News

Jul 26, 2024

Border-casino operator Donaco International Ltd has achieved a 164.17-percent year-on-year increase in its latest quarterly group earnings before interest, taxation, depreciation and amortisation...Sign up to our FREE Newsletter

(Click here for more)

(Click here for more)

Pick of the Day

”We’ve got more traction outside of Macau at the moment. But Macau’s going be a bigger focus for us”

David Punter

Regional representative at Konami Australia

Most Popular

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024  Macau regulator probes unlicensed gaming agents July 24, 2024

Macau regulator probes unlicensed gaming agents July 24, 2024  Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024

Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024  Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024

Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024  Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024

Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024