GEN Singapore 1Q profit up 20pct, beats market consensus

May 10, 2018 Newsdesk Latest News, Singapore, Top of the deck

Casino operator Genting Singapore Plc reported a net profit of nearly SGD217.2 million (US$162.3 million) for the first quarter of 2018, a 19.9-percent increase compared to SGD181.1 million in the first three months of 2017. The quarterly results beat market estimates, as gross gaming revenue (GGR) came above analysts’ expectations.

Group wide revenue for the period climbed 15 percent year-on-year to SGD675.1 million, the company said in a filing on Thursday. Operating profit for the period rose by 8 percent year-on-year, to approximately SGD281.8 million.

“Details of [Genting Singapore’s] results were impressive across the board, i.e., meaningful share gains in both VIP and mass, solid recovery in non- gaming, and near-record margins,” said brokerage JP Morgan.

“We cannot help but think the market is too sceptical about its [Genting Singapore’s] earnings power … as well as its execution and potential,” said analysts DS Kim, Sean Zhuang and Aditya Srinath in a Friday note.

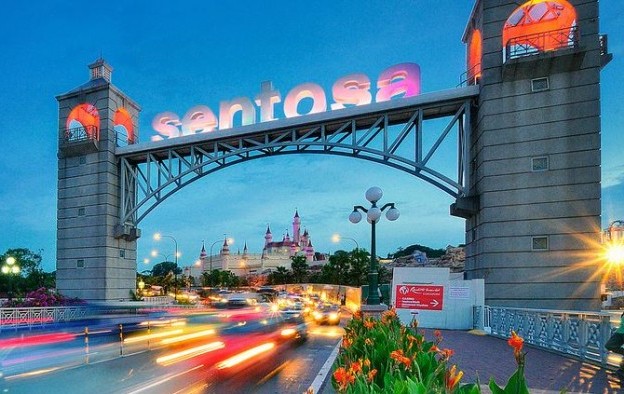

Genting Singapore is the operator of Singapore casino complex Resorts World Sentosa (pictured) and is a subsidiary of Malaysian conglomerate Genting Bhd.

The company reported GGR of SGD507.4 million for the three months ended March 31, up 16.8 percent from a year earlier.

Genting Singapore said it “further grew” its VIP and premium mass segments during the reporting period. “VIP rolling volume trended upwards [in the first quarter], with impairment of trade receivables remaining relatively stable,” said the firm.

The casino operator reported impairment on trade receivables – which includes bad credit extended to VIP players – of approximately SGD9.1 million in the quarter, down 39.6 percent compared to nearly SGD15 million a year earlier.

Adjusted earnings before interest, taxation, depreciation and amortisation (EBITDA) came in at SGD358.9 million in first quarter 2018, up 26.7 percent from the prior-year period.

Genting Singapore said its non-gaming business recorded a 10-percent year-on-year increase in revenue in the first three months of 2018, to SGD167.1 million.

In Thursday’s filing, the company said that the revenue and adjusted EBITDA improvement was “on the back of healthy growth in volumes across all major business segments”.

“The ongoing strategy to focus on affluent regional business proved to be effective as the mass and premium mass business continued to deliver encouraging results,” stated the company. It said additionally the Chinese New Year holiday in February “saw bustling VIP rolling volume [at Resorts World Sentosa], notwithstanding a calibrated credit risk model”.

‘Opening the taps’

Analyst Grant Govertsen of Union Gaming Securities Asia Ltd said in a Thursday note that the “upside surprise” in Genting Singapore’s first-quarter results “was driven almost entirely by higher than expected VIP volume”.

He added: “The last two quarters of 2017 saw year-on-year growth in VIP volume of 27 percent and 10 percent, respectively, with volume of around SGD7.5 billion in each quarter … We estimate that [VIP] volume was actually closer to SGD9.3 billion [in first quarter 2018] (+36 percent year-on-year, +25 percent quarter-on-quarter).”

Mr Govertsen said such growth could be explained by the fact that Genting Singapore had reduced in recent years its exposure to VIPs “after getting burned with high levels of bad debt”. “Now with their credit programme in better shape, management has begun ‘opening the taps’ a bit more and their VIP programme is responding in kind,” he added.

Brokerage Sanford C. Bernstein Ltd however cautioned against a VIP credit policy that could be too loose. “The increase in credit needs to be watched as the company had previously gotten itself into an excessive bad debt situation,” analysts Vitaly Umansky, Zhen Gong and Cathy Huang wrote in a Thursday memo.

Genting Singapore said in Thursday’s filing that progress for the establishment of casino resorts in Japan “has been very encouraging”. The company has declared itself a contender for a Japan casino licence.

The Japanese government endorsed on April 27 an Integrated Resorts (IR) Implementation Bill, which now needs to be voted by the country’s parliament. The government expects for the bill to pass the Diet during the ongoing session through June 20.

“We are actively preparing for the ensuing bidding exercise by the respective government authorities,” said the casino firm in its filing.

On a conference call with analysts following the announcement of the quarterly results, Genting Singapore’s management said it was “optimistic” that a set of bills essential for the launch of a casino industry in Japan – including a bill on responsible gambling – would be approved by the country’s parliament still this year, according to Sanford Bernstein’s note.

Related articles

-

MBS Tower 3 rooms revamp now by 2Q...

MBS Tower 3 rooms revamp now by 2Q...Jul 25, 2024

-

Sands China 2Q EBITDA down q-o-q amid...

Sands China 2Q EBITDA down q-o-q amid...Jul 25, 2024

More news

-

Donaco EBITDA up y-o-y to above US$4mln...

Donaco EBITDA up y-o-y to above US$4mln...Jul 26, 2024

-

HK listed Palasino upgrades Czech...

HK listed Palasino upgrades Czech...Jul 26, 2024

Latest News

Jul 26, 2024

Border-casino operator Donaco International Ltd has achieved a 164.17-percent year-on-year increase in its latest quarterly group earnings before interest, taxation, depreciation and amortisation...Sign up to our FREE Newsletter

(Click here for more)

(Click here for more)

Pick of the Day

”We’ve got more traction outside of Macau at the moment. But Macau’s going be a bigger focus for us”

David Punter

Regional representative at Konami Australia

Most Popular

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024  Macau regulator probes unlicensed gaming agents July 24, 2024

Macau regulator probes unlicensed gaming agents July 24, 2024  Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024

Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024  Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024

Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024  Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024

Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024