GEN Singapore says ‘well placed’ for Japan casino bid

Feb 23, 2017 Newsdesk Latest News, Singapore, Top of the deck

Casino operator Genting Singapore Plc says it “has sufficient financial resources” and is “well placed” to bid for a casino licence in Japan.

“The group has completed a study of our capital structure, and over the next three years will execute a corporate finance strategy that fulfills our various investment requirements including integrated resort projects, and yet maintaining an efficient capital funding model,” Genting Singapore said in commentary included in its fourth-quarter 2016 results announcement, released on Tuesday.

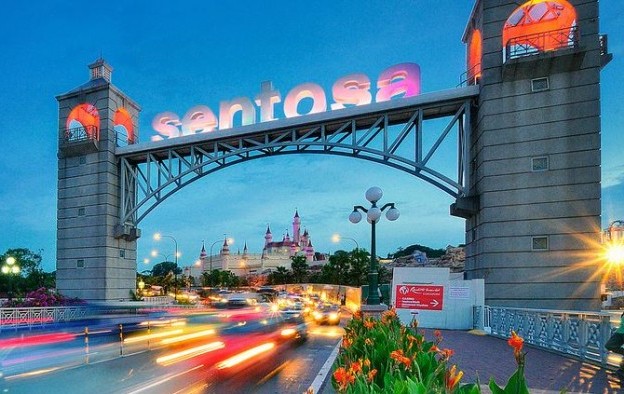

The company is the operator of Singapore casino complex Resorts World Sentosa (pictured) and is a subsidiary of Malaysian conglomerate Genting Bhd.

Several international casino operators – including Las Vegas Sands Corp, MGM Resorts International, Melco Crown Entertainment Ltd and Hard Rock International Inc – have recently restated their interest in a casino licence in Japan.

Legislation making casino gambling legal in Japan came officially into effect on December 26, although investment analysts have said that it could be beyond the year 2021 before the first Japanese casino resort opens.

That is because after approval of the enabling bill legalising casino resorts at the conceptual level, a second piece of legislation has now to be passed, detailing the specifics with respect to licensing, investment, location and taxation. No schedule has been proposed by the Japanese government for the passage of the second bill.

“The field is getting a lot more crowded and suggests the odds [for a Japanese casino licence] are getting longer for Genting Singapore,” Union Gaming Securities Asia Ltd’s Grant Govertsen said in a note following the casino operator’s results announcement.

Brokerage CLSA Ltd estimates a Japanese casino industry could be worth US$10 billion annually even if only two resorts were permitted.

Sanford C. Bernstein Ltd, another brokerage, said in a Tuesday note that the Japan topic had been heavily discussed on Genting Singapore’s fourth-quarter earnings call with investment analysts.

Analysts Vitaly Umansky, Zhen Gong and Yang Xie said in their note that Genting Singapore’s management team favoured a casino scheme in Osaka, with Yokohama also mentioned as a possibility. The company estimated US$8 billion to US$12 billion would be required for a casino resort in a major location in Japan. Genting Singapore would be willing to take on a local partner, but would prefer a majority stake in any scheme, added the Sanford Bernstein note.

Back to black in 4Q

Genting Singapore reported a net profit of SGD159.2 million (US$112.4 million) in the fourth quarter of 2016, compared to a loss of SGD7.8 million a year earlier. The firm said the improvement was related to reduced bad debt provisions – down by 14.2 percent year-on-year – and improved gaming revenue from the premium mass segment.

“With ongoing uncertainty in the macroeconomic and political environment, coupled with a difficult Asian gaming market, we continue to adopt a measured approach in the VIP gaming business,” Genting Singapore stated in its results announcement.

The firm added: “The impairment of receivables relating to this business segment has reduced since we calibrated our credit policies and remodelled our commission structure. We have seen our profit margins improve in this segment.”

Gaming revenue at Resorts World Sentosa was SGD398.6 million in the three months ended December 31, up 6.6 percent in year-on-year terms. Non-gaming revenue declined by 8.4 percent to SGD158.5 million.

Genting Singapore did not provide a breakdown of performance by gaming segment. Union Gaming’s Mr Govertsen said he estimated VIP gross gaming revenue (GGR) at Resorts World Sentosa had grown by 3 percent year-on-year in the fourth quarter of 2016 “due to exceptionally low hold in the fourth quarter 2015”. He added that mass and slot-machine GGR for the three months ended December 31 was likely to have declined by 11 percent year-on-year.

Genting Singapore posted a 28.9-percent year-on-year increase in adjusted earnings before interest, taxation, depreciation and amortisation (EBITDA) in the fourth quarter, to SGD233.7 million.

Its results were also helped by a net foreign exchange gain of SGD65.5 million, compared with a loss of SGD22.6 million a year earlier.

Genting Singapore reported that full-2016 revenue declined by 7.2 percent to SGD2.23 billion. Adjusted EBITDA for the period was SGD779.0 million, down by 14.9 percent in year-on-year terms. The firm achieved full-year net profit of SGD266.3 million for the 12 months ended December 31, representing a year-on-year increase of more than 250 percent.

On Tuesday, Genting announced a final dividend for 2016 of SGD0.015 per share, unchanged from a year earlier.

Related articles

-

Universal Ent raises US$800mln to...

Universal Ent raises US$800mln to...Jul 24, 2024

-

New Hoiana CFO is former Resorts World...

New Hoiana CFO is former Resorts World...Jul 08, 2024

More news

-

Donaco EBITDA up y-o-y to above US$4mln...

Donaco EBITDA up y-o-y to above US$4mln...Jul 26, 2024

-

HK listed Palasino upgrades Czech...

HK listed Palasino upgrades Czech...Jul 26, 2024

Latest News

Jul 26, 2024

Border-casino operator Donaco International Ltd has achieved a 164.17-percent year-on-year increase in its latest quarterly group earnings before interest, taxation, depreciation and amortisation...Sign up to our FREE Newsletter

(Click here for more)

(Click here for more)

Pick of the Day

”We’ve got more traction outside of Macau at the moment. But Macau’s going be a bigger focus for us”

David Punter

Regional representative at Konami Australia

Most Popular

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024  Macau regulator probes unlicensed gaming agents July 24, 2024

Macau regulator probes unlicensed gaming agents July 24, 2024  Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024

Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024  Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024

Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024  Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024

Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024