Genting Singapore 2Q profit beats estimates

Aug 02, 2017 Newsdesk Latest News, Singapore, Top of the deck

Genting Singapore Plc reported net profit of SGD143.3 million (US$105.4 million) for the second quarter of 2017, compared to a net loss SGD10.5 million in the prior-year period. Adjusted earnings before interest, taxation, depreciation and amortisation (EBITDA) rose by 152.2 percent year-on-year to SGD292.7 million.

“All major businesses registered stronger EBITDA at the back of improved operating margin as we continue to drive strategy to focus on better margin business and maintain lower impairment of receivables,” Genting Singapore said in a filing to the Singapore Exchange on Wednesday.

Genting Singapore beat analysts’ expectations as “operations stabilise”, said brokerage Union Gaming Securities Asia Ltd. Analyst Grant Govertsen wrote in a note on Wednesday that Genting Singapore’s revenue and property-level EBITDA were above the brokerage’s forecast for the quarter.

“The beat at the EBITDA line was driven primarily by an improving margin story now that the bad debt situation is in check, as well as slightly better performance in the mass and non-gaming segments relative to our expectations,” he added.

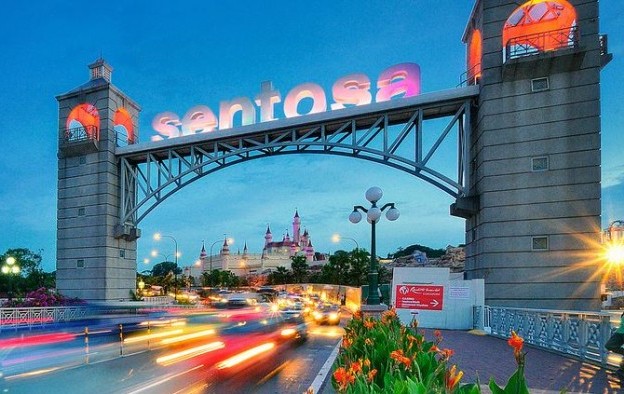

The company – a subsidiary of Malaysian conglomerate Genting Bhd – is the operator of Singapore casino complex Resorts World Sentosa (pictured).

“The group has achieved revenue growth for three sequential quarters,” Genting Singapore stated in its results announcement. “Business momentum remained healthy [in the second quarter of 2017] with 24 percent year-on-year increase in revenue to SGD596.1 million attributable to higher rolling win percentage in the premium player business,” it added.

The company’s gaming revenue increased by 33.3 percent year-on-year, to SGD442.3 million. Genting Singapore does not disclose detailed quarterly segment data on VIP and mass market casino operations.

“In the gaming business segment, we delivered steady earnings as the VIP business remains stable,” Genting Singapore said.

It added: “Following the execution of a more measured credit policy, the impairment of receivables has been reduced significantly.”

The company reported an impairment loss on trade receivables – including credit extended to VIP players but not paid back – of SGD14.7 million for the quarter, down 72.6 percent from the prior-year period.

For the first half of 2017, Genting Singapore reported revenue of SGD1.18 billion, up 8.6 percent in year-on-year terms. Adjusted EBITDA grew by 84.7 percent to SGD576.0 million “contributed by higher revenue, lower impairment of receivables and the cost efficiency arising from the initiatives implemented since 2016”.

Genting Singapore recorded a net profit of SGD324.4 million for the first six months of 2017, compared to SGD0.3 million in the prior-year period. The result was aided by a gain on disposal of SGD96.3 million related to the firm’s sale of its 50-percent stake in a casino project under construction on Jeju Island in South Korea. The stake was bought by joint venture partner Landing International Development Ltd for SGD596.3 million and the deal was concluded in January.

The firm also stated it was “closely following” the casino legalisation process in Japan.

Legislation making casino gambling legal in Japan came into effect in December last year. After approval of the enabling bill legalising integrated resorts at the conceptual level, a second piece of legislation – the IR (Integrated Resorts) Implementation Bill – has now to be passed, detailing the specifics, including how casinos are administered and regulated.

On Tuesday, Japan’s Office of Integrated Resort Regime Promotion – a body made up of professional civil servants advising the government on the IR Implementation Bill – delivered to the Japanese government a report featuring a set of suggestions on how to regulate the country’s nascent casino industry.

Genting Singapore announced on Wednesday an interim dividend of SGD0.015 per ordinary share, to be paid on September 20.

Related articles

-

New Hoiana CFO is former Resorts World...

New Hoiana CFO is former Resorts World...Jul 08, 2024

-

Paradise Co plans new Walkerhill VIP...

Paradise Co plans new Walkerhill VIP...Jul 02, 2024

More news

-

Donaco EBITDA up y-o-y to above US$4mln...

Donaco EBITDA up y-o-y to above US$4mln...Jul 26, 2024

-

HK listed Palasino upgrades Czech...

HK listed Palasino upgrades Czech...Jul 26, 2024

Latest News

Jul 26, 2024

Border-casino operator Donaco International Ltd has achieved a 164.17-percent year-on-year increase in its latest quarterly group earnings before interest, taxation, depreciation and amortisation...Sign up to our FREE Newsletter

(Click here for more)

(Click here for more)

Pick of the Day

”We’ve got more traction outside of Macau at the moment. But Macau’s going be a bigger focus for us”

David Punter

Regional representative at Konami Australia

Most Popular

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024  Macau regulator probes unlicensed gaming agents July 24, 2024

Macau regulator probes unlicensed gaming agents July 24, 2024  Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024

Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024  Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024

Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024  Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024

Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024