Genting Singapore posts 62-pct profit fall in 3Q

Nov 13, 2015 Newsdesk Latest News, Singapore, Top of the deck

Genting Singapore Plc reported a 62 percent year-on-year decline in third quarter net profit to SGD37.2 million (US$26.2 million), the company announced on Thursday. The decrease was related to a dip in gaming revenues and an increase in write-offs, the firm stated in a filing to the Singapore Exchange.

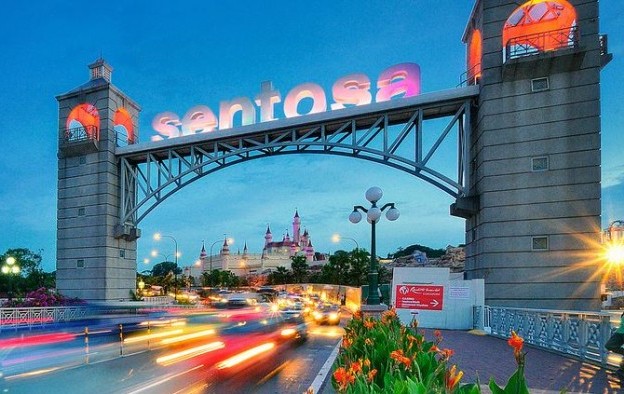

The company is the operator of Singapore casino complex Resorts World Sentosa (pictured) and is a subsidiary of Malaysian conglomerate Genting Bhd.

Genting Singapore reported gaming revenue of SGD451.8 million for the three months ended September 30, down by 5 percent. The firm stated the decline was a result of “a lower business volume in the premium business”.

Non-gaming revenues were up 10 percent year-on-year to SGD183.9 million, attributable to a better performance from Resorts World Sentosa’s leisure attractions and hotel businesses.

Genting Singapore reported an impairment loss on trade receivables of SGD92.5 million for the quarter, more than double the SGD39.7 million recorded a year ago. That included bad credit extended to VIP players.

“We are progressively managing our collections to significantly reduce our quarterly bad debt provisions into 2016,” the company stated.

“Management cautioned that it may take another one to two quarters to unwind the uncollectible accounts relating to the credit provided to VIP customers in the past 18 months,” commented Sanford C. Bernstein Ltd in Hong Kong.

“The company has been tightening its credit policy over the past three-plus quarters; therefore, going forward, we remain optimistic of management’s prudent control of the bad debt provision after the current series of write-offs are finalised over the next one to two quarters,” analysts Vitaly Umansky, Simon Zhang and Bo Wen wrote in a Thursday note.

Losing ground

Rival property Marina Bay Sands, owned by Las Vegas Sands Corp – the only other existing casino resort in Singapore – reported that its adjusted property earnings before interest, taxation, depreciation and amortisation (EBITDA) increased 10.8 percent year-on-year to US$389.7 million in the third quarter. The better performance was driven by growth in mass play from visitors to Singapore and “healthy” VIP volume, the parent company said last month.

“Resorts World Sentosa continues to lag its peer Marina Bay Sands in market share,” Union Gaming Securities Asia Ltd analyst Grant Govertsen wrote in a note following the announcement of Genting Singapore’s third quarter results.

He added: “We calculate that Resorts World Sentosa had a 36 percent share of rolling chip volume during the quarter, and an approximate 40 percent share of mass market gross gaming revenue. In the context of a tough operating environment, we would look for this disparity to continue (and potentially widen) for the foreseeable future.”

According to Union Gaming estimates, Genting Singapore generated rolling chip volume of SGD9 billion in the three months ended September 30, a decline of 50 percent year-on-year and a sequential decrease of 20 percent. Mass market gross gaming revenue was down around 9 percent from a year earlier and flat on a sequential basis, Union Gaming added.

Genting Singapore stated in Thursday’s filing that its focus in the gaming market remained in the premium mass and mass business segments.

The firm added: “With the continued uncertainty of China’s economic strength and environment, and its effect on the regional ASEAN [Association of Southeast Asian Nations] economy, we continue to be cautious with our VIP premium business. We have right-sized our credit extension to VIP premium customers in line with our risk management criteria.”

Several investment analysts covering the gaming sector have highlighted the risk of any Asian casino business model relying on VIP Chinese gamblers during the current economic and policy adjustments that China is undergoing.

Genting Singapore has a partnership with mainland China real estate developer Landing International Development Ltd to build a US$1.8 billion casino resort on South Korea’s Jeju Island, to be named Resorts World Jeju. The property will be modelled after Resorts World Sentosa. The project broke ground in February.

“Soil works in Resorts World Jeju are progressing as per schedule, and are almost completed,” Genting Singapore said in Thursday’s filing.

It added: “We have recently obtained our construction permit and target to commence building works by early next year… The soft opening of the initial phase of our Jeju IR is targeted for end 2017.”

The firm stated it was “sanguine” about prospects for the passage of a gaming bill in Japan allowing casino resorts in Japan. But that should only take place next year at the earliest, according to the latest news.

Related articles

-

New Hoiana CFO is former Resorts World...

New Hoiana CFO is former Resorts World...Jul 08, 2024

-

Some players avoiding Macau amid cash...

Some players avoiding Macau amid cash...Jul 02, 2024

More news

-

Donaco EBITDA up y-o-y to above US$4mln...

Donaco EBITDA up y-o-y to above US$4mln...Jul 26, 2024

-

HK listed Palasino upgrades Czech...

HK listed Palasino upgrades Czech...Jul 26, 2024

Latest News

Jul 26, 2024

Border-casino operator Donaco International Ltd has achieved a 164.17-percent year-on-year increase in its latest quarterly group earnings before interest, taxation, depreciation and amortisation...Sign up to our FREE Newsletter

(Click here for more)

(Click here for more)

Pick of the Day

”We’ve got more traction outside of Macau at the moment. But Macau’s going be a bigger focus for us”

David Punter

Regional representative at Konami Australia

Most Popular

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024  Macau regulator probes unlicensed gaming agents July 24, 2024

Macau regulator probes unlicensed gaming agents July 24, 2024  Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024

Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024  Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024

Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024  Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024

Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024