Macau earnings estimates risk cut on ‘worst’ quarter: CS

Apr 08, 2015 Newsdesk Latest News, Macau, Top of the deck

The first quarter of 2015 is the “worst quarter since the Macau operators listed” in Hong Kong, said a note from Credit Suisse AG on Tuesday. The bank added that following the first quarter results season for the Macau operators, the market could cut previous earnings projections for 2015.

“We see room for disappointing profit margin amid sharp revenue decline, cost pressure and intense market competition – earnings cut likely post-first quarter result,” said the note from Hong Kong-based analysts Kenneth Fong and Isis Wong.

Quarterly results season is expected to start with Sands China Ltd and Galaxy Entertainment Group Ltd in late April, according to Daiwa Securities Group Inc.

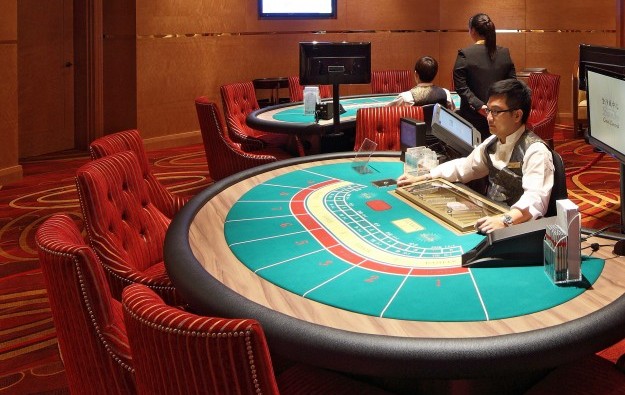

Market wide cost pressures include wages. Only Macau residents can be casino dealers, and more might be needed when the new Cotai resorts start opening from this year. The gaming operators’ right to import some other kinds of workers is subject to a quota system. Macau’s unemployment rate was stuck at 1.7 percent and the underemployment rate at only 0.4 percent in the December to February period, which has helped to fuel wage inflation.

Player reinvestment costs are also said to have been rising, as the casino operators try to secure the loyalty of gamblers that are still coming to Macau amid mainland China’s anti-corruption crackdown. Promotional allowances as a percentage of gross gaming revenue reached as high as 7 percent for Sands China Ltd in the fourth quarter of 2014, wrote Morgan Stanley Research Asia Pacific in a report in late March.

Cameron McKnight, Rich Cummings and Tiffany Lee of Wells Fargo Securities LLC in New York, said in a note on Tuesday that the market-wide 39 percent decline in gross gaming revenue (GGR) seen for March – confirmed by official figures issued by the Macau government on April 1 – could soften sequentially in April and May.

“If year-to-date average daily revenue of MOP720 million [US$90.2 million] holds, April and May gaming growth would be -31 percent year-on-year,” said Wells Fargo.

Daiwa analysts Jamie Soo and Adrian Chan said in their Tuesday note that local checks suggested “overall softness” was likely in April leading into the Labour Day holiday in May.

They added: “We expect investors to also be looking for news on Galaxy Phase 2’s new gaming-table allocations, which are expected to be announced between April and May 2015.”

That was a reference to Galaxy Entertainment’s HKD19.6-billion (US$2.5-billion) addition to its Galaxy Macau casino resort on Cotai, which is due to open on May 27. The firm has not yet said publicly how many tables it expects to get. But Galaxy Entertainment has said in previous public statements that Galaxy Macau Phase 2 has capacity for 500 tables and 1,000 slot machines.

Nonetheless Daiwa warned: “The latest [market revenue] numbers continue to support our view that the new supply in 2015 may not create incremental demand in this macro climate.”

The US$3.2-billion Studio City casino resort, majority-owned by Melco Crown Entertainment Ltd, is due to open in the third quarter of 2015. The firm’s chief executive Lawrence Ho Yau Lung in January said he had “no idea” how many gaming tables the property would get. It has the capacity for 500.

Related articles

-

Macau GGR can reach US$60bln in 10 yrs:...

Macau GGR can reach US$60bln in 10 yrs:...Jul 12, 2023

-

Nagasaki no news yet on central govt...

Nagasaki no news yet on central govt...May 17, 2023

More news

-

Donaco EBITDA up y-o-y to above US$4mln...

Donaco EBITDA up y-o-y to above US$4mln...Jul 26, 2024

-

HK listed Palasino upgrades Czech...

HK listed Palasino upgrades Czech...Jul 26, 2024

Latest News

Jul 26, 2024

Border-casino operator Donaco International Ltd has achieved a 164.17-percent year-on-year increase in its latest quarterly group earnings before interest, taxation, depreciation and amortisation...Sign up to our FREE Newsletter

(Click here for more)

(Click here for more)

Pick of the Day

”We’ve got more traction outside of Macau at the moment. But Macau’s going be a bigger focus for us”

David Punter

Regional representative at Konami Australia

Most Popular

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024  Macau regulator probes unlicensed gaming agents July 24, 2024

Macau regulator probes unlicensed gaming agents July 24, 2024  Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024

Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024  Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024

Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024  Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024

Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024