Macau VIP GGR likely soft in rest of 2H: Chau Suncity

Sep 09, 2019 Newsdesk Latest News, Macau, Top of the deck

The market-wide year-on year contraction in Macau’s VIP gross gaming revenue (GGR) has continued in the current quarter and is likely to extend into the final quarter of this year.

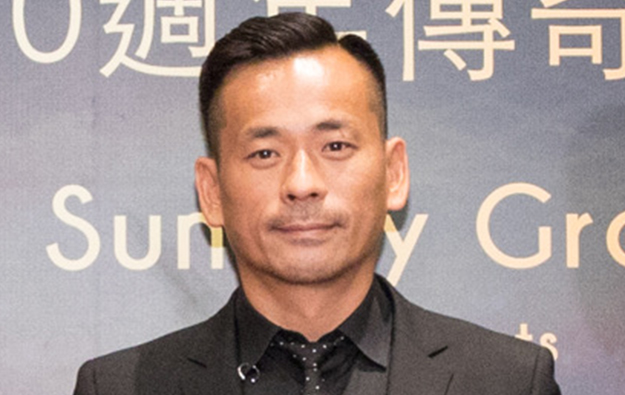

That is a suggestion of Alvin Chau Cheok Wa (pictured in file photo), boss of major Macau junket brand Suncity Group, in comments published on Monday in the Chinese-language newspaper the Hong Kong Economic Journal.

Mr Chau stressed his remarks applied to the market as a whole. He gave no specific comment on his own junket brand’s likely second-half performance.

A report by JP Morgan Securities (Asia Pacific) Ltd recently suggested – citing market intelligence – that Macau’s “top three” junket brands saw rolling chip turnover – another measure of industry performance – dip 25 percent year-on-year in August. The financial institution did not mention the junket firms by name, but it is a matter of public record that the Macau junket sector has been facing regulatory and political headwinds in relation to its gaming business.

Mr Chau was cited in Monday’s newspaper report as saying Macau’s market-wide VIP gaming revenue could see a “15 percent” year-on-year decline in the current quarter, and a “20 percent” year-on-year fall in the final quarter.

Mr Chau is chief executive and director of the privately-held Macau junket firm Suncity Group. He is also controls and is chairman of Hong Kong-listed Suncity Group Holdings Ltd. The latter is an equity investor in the under-development Hoiana casino resort scheme in Vietnam and will also manage the casino there. The listed entity also has deals either to manage or advise on casino operations at several third-party owned venues in the Asia-Pacific region.

The junket boss was also cited in the Monday newspaper report as saying players’ demand for credit from Macau junket operators had declined, along with the frequency of their trips to Macau, as some gaming patrons wanted to “reduce risk of being investigated” by mainland Chinese authorities amid what he said was China’s effort to combat “triad-related” criminal activities.

The junket boss also noted the amount of time needed by high rollers in order to pay back gaming loans had lengthened. He said factors included: a trend of depreciation in China’s currency the yuan – Macau bets are generally denominated in Hong Kong dollars, a currency pegged against the value of the U.S. dollar ; China’s slowing economy; and reinforced controls against capital flight from mainland China.

Macau’s VIP baccarat GGR fell 15.6 percent year-on-year in the second quarter of this year to slightly above MOP34.6 billion (US$4.30 billion), according to official data released by the city’s Gaming Inspection and Coordination Bureau.

The Macau market’s GGR tally for the first half of this year stood at about MOP149.50 billion, a year-on-year contraction of 0.5 percent. During the period, the city’s aggregate VIP GGR stood at MOP71.82 billion, a decline of 14.5 percent from MOP83.99 billion a year ago.

Related articles

-

Top court confirms Alvin Chau’s...

Top court confirms Alvin Chau’s...Jul 03, 2024

-

Insufficient evidence to bar CTFE for...

Insufficient evidence to bar CTFE for...May 03, 2024

More news

-

Donaco EBITDA up y-o-y to above US$4mln...

Donaco EBITDA up y-o-y to above US$4mln...Jul 26, 2024

-

HK listed Palasino upgrades Czech...

HK listed Palasino upgrades Czech...Jul 26, 2024

Latest News

Jul 26, 2024

Border-casino operator Donaco International Ltd has achieved a 164.17-percent year-on-year increase in its latest quarterly group earnings before interest, taxation, depreciation and amortisation...Sign up to our FREE Newsletter

(Click here for more)

(Click here for more)

Pick of the Day

”We’ve got more traction outside of Macau at the moment. But Macau’s going be a bigger focus for us”

David Punter

Regional representative at Konami Australia

Most Popular

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024  Macau regulator probes unlicensed gaming agents July 24, 2024

Macau regulator probes unlicensed gaming agents July 24, 2024  Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024

Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024  Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024

Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024  Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024

Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024