MGP proposes merger with Caesars’ REIT

Jan 17, 2018 Newsdesk Latest News, Top of the deck, World

MGM Growth Properties LLC (MGP), the real estate investment trust (REIT) controlled by U.S.-based casino operator MGM Resorts International, has offered to purchase the REIT that manages several properties operated by market-rival casino firm Caesars Entertainment Corp.

MGM Growth Properties is proposing to acquire 100 percent of Vici Properties Inc’s outstanding common stock for US$19.50 per share, according to a letter released on Tuesday. “We believe this represents a meaningful premium to the potential value your current shareholders would receive in the event of an initial public offering, especially after considering the fees, discounts, dilution, risks and uncertainties associated with such an offering,” the document added.

The letter was signed by James Murren and James Stewart, respectively, chairman and chief executive of MGM Growth Properties. Mr Murren is also chairman and CEO of MGM Resorts.

In a separate statement, MGM Growth Properties said there had been discussions between executives of the two REITs in, respectively, December and early January. But it stated: “To date, Vici has elected not to engage in meaningful discussions.”

“MGM Growth Properties believes that a proposed combination is extremely attractive strategically and financially for both Vici and MGM Growth Properties,” it added.

Under the terms of the proposal, the consideration would be in the form of MGM Growth Properties shares. MGM Growth Properties said it would also be willing to offer a portion of the consideration in the form of cash.

Upon completion of the proposed transaction, Vici shareholders would own approximately 43 percent of the combined company assuming an all-stock transaction and based on MGM Growth Properties’ current share price.

According to the proposal, the combined REIT would have an enterprise value of approximately US$22 billion. MGM Resorts’ ownership stake in the combined REIT would be reduced to 41 percent.

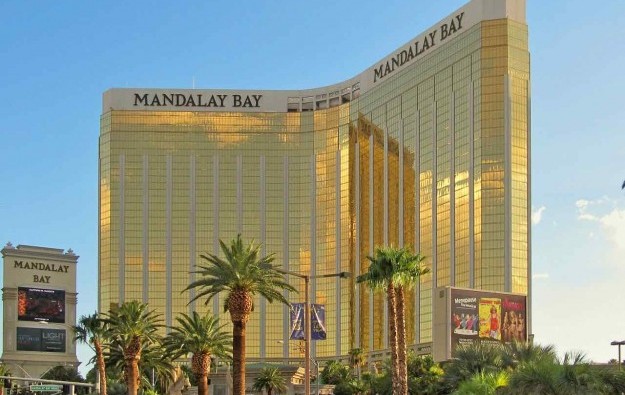

MGM Resorts is a majority owner of publicly-traded MGM Growth Properties. The REIT – created in 2016 – owns several real estate assets located in the United States, including some of the most iconic properties in Las Vegas, such as Mandalay Bay (pictured) and The Mirage. MGM Resorts is the parent company of Macau-based casino operator MGM China Holdings Ltd.

Vici was formed as part of Caesars Entertainment’s bankruptcy reorganisation, and it’s privately-owned by some of the group’s former creditors, according to information previously released by the casino operator. Vici’s property portfolio consists of 20 gaming properties, including the Caesars Palace in the Las Vegas Strip.

Related articles

-

MGM Resorts expands digital business...

MGM Resorts expands digital business...Jun 25, 2024

-

MGM Osaka developer environmental...

MGM Osaka developer environmental...Jun 20, 2024

More news

-

Donaco EBITDA up y-o-y to above US$4mln...

Donaco EBITDA up y-o-y to above US$4mln...Jul 26, 2024

-

HK listed Palasino upgrades Czech...

HK listed Palasino upgrades Czech...Jul 26, 2024

Latest News

Jul 26, 2024

Border-casino operator Donaco International Ltd has achieved a 164.17-percent year-on-year increase in its latest quarterly group earnings before interest, taxation, depreciation and amortisation...Sign up to our FREE Newsletter

(Click here for more)

(Click here for more)

Pick of the Day

”We’ve got more traction outside of Macau at the moment. But Macau’s going be a bigger focus for us”

David Punter

Regional representative at Konami Australia

Most Popular

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024  Macau regulator probes unlicensed gaming agents July 24, 2024

Macau regulator probes unlicensed gaming agents July 24, 2024  Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024

Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024  Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024

Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024  Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024

Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024