Moody’s keeps GEN Singapore rating, outlook negative

May 20, 2020 Newsdesk Latest News, Singapore, Top of the deck

Moody’s Investors Service Inc has confirmed the “A3” issuer rating of casino developer and operator Genting Singapore Ltd. The ratings agency changed however the firm’s outlook to “negative”, according to a Tuesday report.

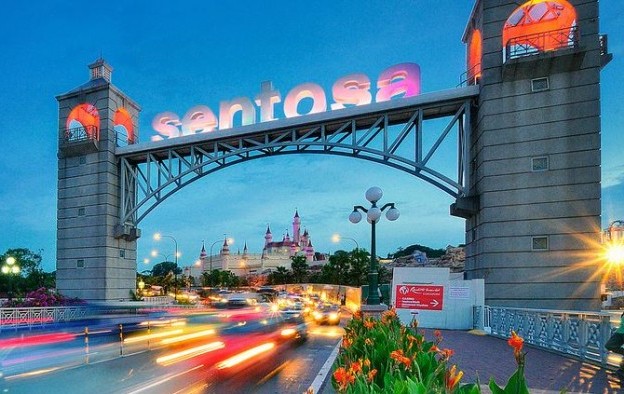

Genting Singapore is the operator of the Resorts World Sentosa casino resort (pictured) in Singapore. It is also pursuing the opportunity to develop a Japan casino resort as part of that country’s first phase of liberalisation.

The confirmation of Genting Singapore’s rating reflected Moody’s expectation that the casino operator’s “strong balance sheet, supported by sizeable cash holdings and minimal debt,” would provide the company with “the ability to withstand a severe but temporary cash burn from its weakened operating performance and the closure of Resorts World Sentosa”.

Resorts World Sentosa has been closed since April 7 and the shutdown has been extended until at least June 1.

The rating also took into consideration the relationship and the “degree of independence” between Genting Singapore and its ultimate parent, Genting Bhd. According to the report, Genting Singapore provides only cash to its parent through dividend payouts, “which have represented less than 40 percent of operating cash flows”.

Moody’s said it expected Genting Singapore would “maintain excellent liquidity,” helped by its “sizeable” cash position of SGD3.9 billion (US$2.8 billion) compared to gross balance sheet debt of SGD261 million as of December 31, 2019.

“Although the cash position will deplete assuming continued capital spending for the expansion of Resorts World Sentosa, the company will stay in a net cash position,” said the ratings agency.

Genting Singapore has made a commitment to the Singapore government to spend SGD4.5 billion to expand its facilities at Resorts World Sentosa in return for its casino licence – issued under the city’s casino duopoly – being extended until 2030.

In Tuesday’s report, Moody’s said the “negative” outlook on Genting Singapore reflected “uncertainty around when Resorts World Sentosa will reopen and the pace at which operating performance will recover”.

It added: “At the same time, the negative outlook reflects the weakening credit quality of Genting Bhd, which could pose downside risks to Genting Singapore’s rating.”

Moody’s said in its report that it had downgraded the issuer rating of Genting Bhd to “Baa2” from “Baa1”, with a “negative” outlook.

Related articles

-

MBS Tower 3 rooms revamp now by 2Q...

MBS Tower 3 rooms revamp now by 2Q...Jul 25, 2024

-

Pagcor says it received application for...

Pagcor says it received application for...Jul 19, 2024

More news

-

Donaco EBITDA up y-o-y to above US$4mln...

Donaco EBITDA up y-o-y to above US$4mln...Jul 26, 2024

-

HK listed Palasino upgrades Czech...

HK listed Palasino upgrades Czech...Jul 26, 2024

Latest News

Jul 26, 2024

Border-casino operator Donaco International Ltd has achieved a 164.17-percent year-on-year increase in its latest quarterly group earnings before interest, taxation, depreciation and amortisation...Sign up to our FREE Newsletter

(Click here for more)

(Click here for more)

Pick of the Day

”We’ve got more traction outside of Macau at the moment. But Macau’s going be a bigger focus for us”

David Punter

Regional representative at Konami Australia

Most Popular

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024  Macau regulator probes unlicensed gaming agents July 24, 2024

Macau regulator probes unlicensed gaming agents July 24, 2024  Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024

Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024  Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024

Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024  Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024

Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024