Newly-elected president Marcos’ in-tray has gaming

May 10, 2022 Newsdesk Latest News, Philippines, Top of the deck

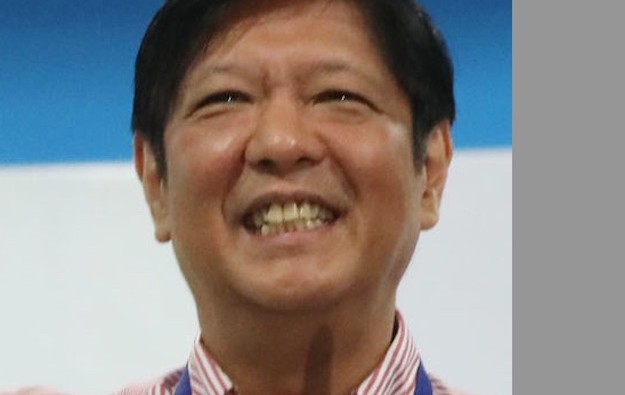

Ferdinand Marcos Jr (pictured), leader-in-waiting for the Philippines, will have a number of key gaming industry-related items in the in-tray.

Taxes from licensed casinos and other forms of authorised gaming have long been an important source of public income in that country, under the supervision of the local regulator, the Philippine Amusement and Gaming Corp (Pagcor).

The creation of Pagcor actually stemmed from a 1977 decree issued by Mr Marcos’ father, Ferdinand Marcos Snr, when the latter was national president. Mr Marcos Snr was initially elected to office, but later ruled as an autocrat, and was ousted from power in 1986.

Reuters reported on Tuesday that an unofficial poll indicated that Mr Marcos Jr – known in the Philippines as “Bongbong” – had exceeded the 27.5 million votes nationwide that were needed to achieve a majority.

Key gaming industry topics now facing Mr Marcos Jr as incoming head of state include whether to continue suspension of the country’s cockfighting contest licences relating to events presented online and known locally as “E-sabong”. Those permits were paused by the outgoing leader, President Rodrigo Duterte, only last week, amid allegations of abductions of people linked to the sector.

Another topic of interest for Mr Marcos Jr will be the development of the Philippine Inland Gaming Operator (PIGO) sector, which has been rolled out via bricks and mortar casino resorts under the current leadership of Pagcor.

A third item will be the future of the holiday island of Boracay as a gaming destination. In August, President Duterte reversed the position he had declared in early 2018, when he had said he opposed casinos being built there.

Related articles

-

China embassy in Manila welcomes POGO...

China embassy in Manila welcomes POGO...Jul 26, 2024

-

RGB says ‘unaffected’ by...

RGB says ‘unaffected’ by...Jul 26, 2024

More news

-

Donaco EBITDA up y-o-y to above US$4mln...

Donaco EBITDA up y-o-y to above US$4mln...Jul 26, 2024

-

HK listed Palasino upgrades Czech...

HK listed Palasino upgrades Czech...Jul 26, 2024

Latest News

Jul 26, 2024

Border-casino operator Donaco International Ltd has achieved a 164.17-percent year-on-year increase in its latest quarterly group earnings before interest, taxation, depreciation and amortisation...Sign up to our FREE Newsletter

(Click here for more)

(Click here for more)

Pick of the Day

”We’ve got more traction outside of Macau at the moment. But Macau’s going be a bigger focus for us”

David Punter

Regional representative at Konami Australia

Most Popular

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024  Macau regulator probes unlicensed gaming agents July 24, 2024

Macau regulator probes unlicensed gaming agents July 24, 2024  Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024

Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024  Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024

Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024  Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024

Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024