No debt needed to fund RWS’ expansion: Moody’s

Feb 25, 2022 Newsdesk Latest News, Singapore, Top of the deck

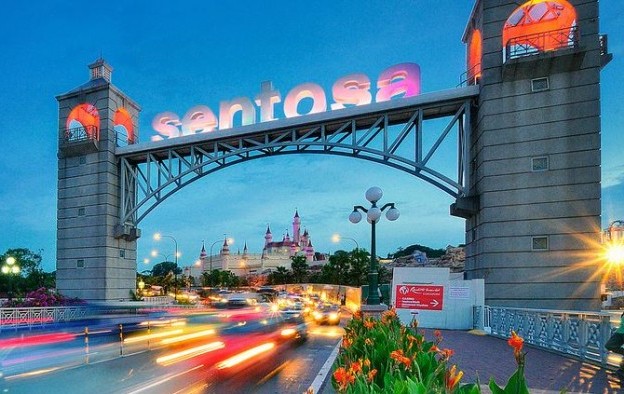

The ‘A3′ issuer rating of Genting Singapore Ltd reflects the company’s liquidity strength, and its capacity to fund the SGD4.5-billion (US$3.3-billion) expansion of its casino complex Resorts World Sentosa “without the need to incur additional debt”, said Moody’s Investors Service in a credit opinion issued on Thursday.

Long-term obligations rated A are considered “subject to low credit risk”, according to the rating agency.

Genting Singapore, controlling one half of Singapore’s casino duopoly, is investing SGD400 million in upgrading some of its attractions and refurbishing three existing hotels at Resorts World Sentosa. These enhancements are part of the SGD4.5-billion expansion plan.

“Given Genting Singapore’s sizable net cash position, it is likely to have sufficient resources to fund the expansion without incurring additional debt,” said Moody’s in its Thursday opinion.

As of end-2021, Genting Singapore had a cash balance of approximately SGD3.3 billion. Moody’s expected the gaming operator to maintain a strong net cash position in 2022 and 2023.

Genting Singapore’s strength in liquidity provided the company “a buffer” in case the recovery in the operating performance of its casino resort complex is slower than expected, said Moody’s.

The rating house estimated Genting Singapore to see its revenue grow from SGD1.07 billion in 2021 to SGD1.61 billion in 2022, and SGD2.23 billion in 2023. The company reported revenue of SGD2.48 billion in 2019, before the onset of Covid-19 pandemic.

The company’s credit outlook was however challenged by its exposure to the “evolving regulatory environment” in Singapore, and to a “geographical concentration risk” as the company generates most of its revenue from Resorts World Sentosa, said Moody’s.

Related articles

-

New Hoiana CFO is former Resorts World...

New Hoiana CFO is former Resorts World...Jul 08, 2024

-

Macau 2025 GGR to be 88pct of pre-Covid...

Macau 2025 GGR to be 88pct of pre-Covid...Jun 28, 2024

More news

-

Donaco EBITDA up y-o-y to above US$4mln...

Donaco EBITDA up y-o-y to above US$4mln...Jul 26, 2024

-

HK listed Palasino upgrades Czech...

HK listed Palasino upgrades Czech...Jul 26, 2024

Latest News

Jul 26, 2024

Border-casino operator Donaco International Ltd has achieved a 164.17-percent year-on-year increase in its latest quarterly group earnings before interest, taxation, depreciation and amortisation...Sign up to our FREE Newsletter

(Click here for more)

(Click here for more)

Pick of the Day

”We’ve got more traction outside of Macau at the moment. But Macau’s going be a bigger focus for us”

David Punter

Regional representative at Konami Australia

Most Popular

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024  Macau regulator probes unlicensed gaming agents July 24, 2024

Macau regulator probes unlicensed gaming agents July 24, 2024  Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024

Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024  Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024

Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024  Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024

Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024