Social impact check on built Dream Tower: Jeju govt

Jan 20, 2020 Newsdesk Latest News, Rest of Asia, Top of the deck

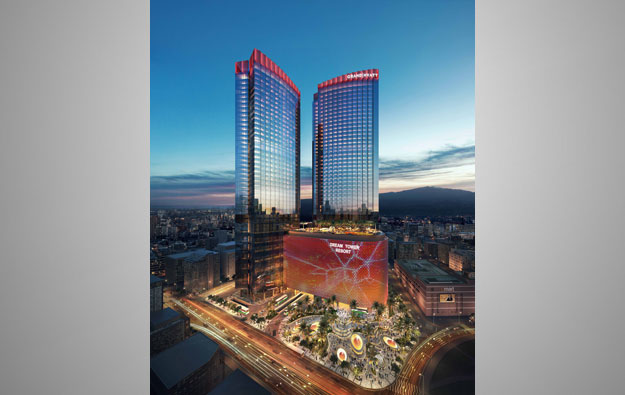

Jeju Dream Tower (pictured in an artist’s rendering), a new resort with foreigner-only casino in a downtown area of Jeju City, the capital of that South Korean holiday island, is to be evaluated by the local authorities regarding its social impact on the host community. The local body responsible for gaming industry oversight affirmed to GGRAsia the information in response to our enquiry.

The structure of the project has already been largely completed according to local media reports.

One of the reasons for the evaluation by local authorities is that the scheme’s promoters have sought to link the gaming licensing regime associated with an existing Jeju casino property, to the new scheme. A similar linking to an existing property’s casino permission happened before Hong Kong-listed Landing International Development Ltd opened in February 2018 the casino at its new Jeju Shinhwa World resort.

Jeju, as a semi-autonomous region, has its own regulatory powers concerning casinos there. The island also offers visa-on-arrival for Chinese tourists – a key target market for local casinos – provided those visitors are coming direct to Jeju via an international flight or cruise sailing.

The impact study regarding Jeju Dream Tower – a project that is promoted by a unit of Lotte Corp, a South Korea-based international conglomerate that has interests including hotels, duty-free shopping and food manufacturing – will consider whether the scheme has local economic benefits, and the project’s effects, if any, on tourism and the local housing and property scene.

According to the Casino Policy Division – which has the local role as a regulator – the evaluation is legally required in cases where an existing Jeju casino operator wishes to expand, by more than two times, its gaming-operations capacity locally.

In July 2018, Lotte Tour Development Co Ltd, the Lotte unit involved in Jeju Dream Tower, said it might apply to transfer the rights of another Jeju venue’s gaming licence to Jeju Dream Tower. At the time, Lotte Tour had announced a deal to acquire the entire capital of Paradise Jeju Lotte Casino – a venue operated by South Korean gaming operator Paradise Co Ltd. The casino is inside the Lotte Hotel Jeju, tourist accommodation operated by Lotte Hotels and Resorts.

According to the reply received by GGRAsia from the Casino Policy Division, the social impact evaluation applicable to Jeju Dream Tower is stipulated in the amended “Regulations on the Management and Supervision of the Jeju Special Self-Governing Province’s Casino Business”. Such modified regulations were passed last month by local lawmakers, and were already in effect, affirmed the regulator.

Other factors to be considered by such a study were: what local employment opportunities were being offered; community security; the cultural and educational influences of a scheme; and its impact on the environment, including residential areas close to a scheme, the Casino Policy Division noted to GGRAsia.

A “deliberation committee” – still to be established – would examine the casino impact assessment report applicable to Jeju Dream Tower, said the regulator. The committee’s review input to the impact assessment report will serve as key reference to the island’s gaming regulator and the governor to judge the suitability of the casino project in question.

“The [deliberation] committee is also authorised to judge on the survey of public opinions that Jeju Dream Tower has to conduct, in order to assess the impact that could be imposed by a casino property on its surrounding neighbourhoods,” the Casino Policy Division noted to us in its emailed response.

The construction of the Jeju Dream Tower began in May 2016. Its 38 floors make it the tallest building on Jeju. The complex is – according to previous announcements by the promoter – to house a Grand Hyatt-branded hotel as well as a casino and other leisure facilities.

(updated, 11.16 am, Jan 21, 2020)

Related articles

-

Kangwon Land 2Q net profit up 64pct...

Kangwon Land 2Q net profit up 64pct...Jul 19, 2024

-

Ex casino exec jailed for manipulated...

Ex casino exec jailed for manipulated...Jul 12, 2024

More news

-

Donaco EBITDA up y-o-y to above US$4mln...

Donaco EBITDA up y-o-y to above US$4mln...Jul 26, 2024

-

HK listed Palasino upgrades Czech...

HK listed Palasino upgrades Czech...Jul 26, 2024

Latest News

Jul 26, 2024

Border-casino operator Donaco International Ltd has achieved a 164.17-percent year-on-year increase in its latest quarterly group earnings before interest, taxation, depreciation and amortisation...Sign up to our FREE Newsletter

(Click here for more)

(Click here for more)

Pick of the Day

”We’ve got more traction outside of Macau at the moment. But Macau’s going be a bigger focus for us”

David Punter

Regional representative at Konami Australia

Most Popular

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024  Macau regulator probes unlicensed gaming agents July 24, 2024

Macau regulator probes unlicensed gaming agents July 24, 2024  Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024

Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024  Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024

Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024  Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024

Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024