S&P shifts Genting outlook to negative amid virus hit

Mar 12, 2020 Newsdesk Latest News, Rest of Asia, Top of the deck, World

Standard & Poor’s Global Ratings revised on Wednesday its outlook on Malaysia’s Genting Bhd and on its wholly-owned unit Resorts World Las Vegas LLC, to “negative” from “stable”. Genting Bhd is parent of the casino and plantations network of businesses founded by the Lim family.

The credit assessment agency said it believed the Covid-19 outbreak would “hit the Genting group hard in 2020,” with such impact “to be felt hardest” in the quarter ending March. “We expect a drastic drop in visitation to gaming properties, and those owned by Genting group are no exception,” it stated.

In terms specifically of the Genting parent’s credit profile, Standard & Poor’s said: “The negative outlook reflects our expectation that Genting will breach our downgrade trigger for the next 12 to 24 months, but its credit profile will recover quickly such that debt/EBITDA [earnings before interest, taxation, depreciation and amortisation] falls below 2.0 times by 2022.”

The ratings agency has at the same time affirmed the “BBB+” long-term issuer credit rating on Genting, according to a Wednesday statement.

The Covid-19 virus outbreak – recorded first in mainland China – has now been declared a pandemic, with infections across the Asia-Pacific region and the globe.

“We revised the outlook on Genting to negative to reflect our view that Genting’s revenue and EBITDA will drop by 20 percent to 25 percent and 25 percent to 30 percent respectively in 2020 because of the ongoing Covid-19 outbreak,” stated the ratings agency.

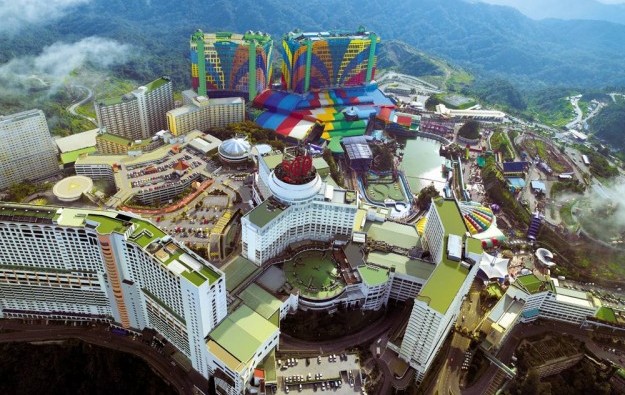

The Genting group has a monopoly in casino gaming in Malaysia – via Genting Malaysia Bhd, which operates Resorts World Genting (pictured in a file photo) – and is also operator in Singapore’s casino gaming duopoly, via Genting Singapore Ltd.

“In Singapore, we expect revenue to decline by 30 percent to 40 percent in 2020, given our belief that the bulk of it is from customers in North Asia,” noted Standard & Poor’s. “In Malaysia, while we acknowledge that day trippers make up about 75 percent of visitors, we forecast weak consumer sentiment amid the virus fear to lower revenue by 20 percent to 25 percent in 2020.”

The Genting group is also developing the US$4.3-billion Resorts World Las Vegas casino resort in Nevada, United States. That property is expected to open in the summer of 2021, according to previous company information.

The ratings agency noted in relation to disruption to Genting group’s business: “This comes at a time when we forecast near-term capital expenditure (capex) to peak in 2020, with Resorts World Las Vegas set to open in the summer of 2021 in the U.S., and our expectation that Genting Singapore will start its SGD4.5 billion [US$3.2 billion] expansion plan.”

In Wednesday’s statement, Standard & Poor’s said it expected Genting Bhd’s credit profile “to improve materially from 2022,” after the opening of the Las Vegas property.

“With the addition of Resorts World Las Vegas from 2021, we forecast revenue and EBITDA to reach record highs in 2022, and Genting’s credit profile to improve materially such that its debt-to-EBITDA ratio will fall below 2.0 times and ratio of funds from operations to debt will stay above 45 percent sustainably thereafter,” said the ratings agency.

The institution said additionally that it expected Resorts World Las Vegas to become a “meaningful earnings contributor” to the Genting group. “When completed, it will be the first new asset to open in Las Vegas in 10 years. Resorts World Las Vegas can benefit from being associated with a known brand name, and can also potentially leverage on partnerships with global hotel brands,” it stated.

Related articles

-

New Hoiana CFO is former Resorts World...

New Hoiana CFO is former Resorts World...Jul 08, 2024

-

Macau 2025 GGR to be 88pct of pre-Covid...

Macau 2025 GGR to be 88pct of pre-Covid...Jun 28, 2024

More news

-

Donaco EBITDA up y-o-y to above US$4mln...

Donaco EBITDA up y-o-y to above US$4mln...Jul 26, 2024

-

HK listed Palasino upgrades Czech...

HK listed Palasino upgrades Czech...Jul 26, 2024

Latest News

Jul 26, 2024

Border-casino operator Donaco International Ltd has achieved a 164.17-percent year-on-year increase in its latest quarterly group earnings before interest, taxation, depreciation and amortisation...Sign up to our FREE Newsletter

(Click here for more)

(Click here for more)

Pick of the Day

”We’ve got more traction outside of Macau at the moment. But Macau’s going be a bigger focus for us”

David Punter

Regional representative at Konami Australia

Most Popular

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024  Macau regulator probes unlicensed gaming agents July 24, 2024

Macau regulator probes unlicensed gaming agents July 24, 2024  Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024

Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024  Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024

Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024  Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024

Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024