TransAct casino sales decline extends into 1Q

May 05, 2016 Newsdesk Industry Talk, Latest News

TransAct Technologies Inc reported a 2.6 percent year-on-year decline in casino and gaming equipment sales in the first quarter of 2016 to US$5.4 million.

This was the third consecutive quarter of casino and gaming equipment sales decline for TransAct as measured in year-on-year terms.

Revenue from the segment was negatively affected by lower international casino and gaming revenue, the firm said in a statement issued on Wednesday.

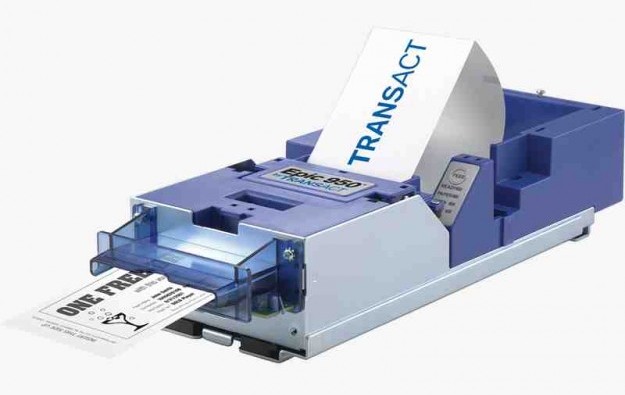

TransAct’s casino and gaming product segment includes ticket printers for gaming machines.

“In the casino and gaming market, we continue to grow domestic share as U.S. sales growth for our Epic 950 printers (pictured) exceeded the growth of the domestic gaming machine market,” Bart Shuldman, chairman and chief executive of TransAct, said in a statement.

He added: “As operators seek to drive revenue growth on their casino floor in an increasingly competitive marketplace, interest in our innovative solution’s ability to target players by printing coupons and promotions in real-time at the gaming device continues to grow.”

In September, TransAct announced an agreement to integrate its Epicentral promotion and bonusing system with Aristocrat Technologies Inc’s Oasis 360 casino management system. TransAct said at the time the goal was to provide casino operators with a comprehensive player reward system.

TransAct’s total net sales revenue for the first quarter of 2016 – including non-gaming related segments – was US$14.4 million, down by 11.2 percent in year-on-year terms. Casino and gaming sales were the main revenue contributor, accounting for 37.9 percent of the total.

Net income in the three months ended March 31 was US$625,000 compared to US$144,000 in the prior-year period.

TransAct on Wednesday announced its board of directors declared a quarterly cash dividend of US$0.08 per share. The dividend will be payable on June 15 to shareholders of record at the close of business on May 20.

Related articles

-

TransAct installs first Epicentral...

TransAct installs first Epicentral...Jun 27, 2024

-

TransAct says in talks with potential...

TransAct says in talks with potential...Jun 04, 2024

More news

-

Donaco EBITDA up y-o-y to above US$4mln...

Donaco EBITDA up y-o-y to above US$4mln...Jul 26, 2024

-

HK listed Palasino upgrades Czech...

HK listed Palasino upgrades Czech...Jul 26, 2024

Latest News

Jul 26, 2024

Border-casino operator Donaco International Ltd has achieved a 164.17-percent year-on-year increase in its latest quarterly group earnings before interest, taxation, depreciation and amortisation...Sign up to our FREE Newsletter

(Click here for more)

(Click here for more)

Pick of the Day

”We’ve got more traction outside of Macau at the moment. But Macau’s going be a bigger focus for us”

David Punter

Regional representative at Konami Australia

Most Popular

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024  Macau regulator probes unlicensed gaming agents July 24, 2024

Macau regulator probes unlicensed gaming agents July 24, 2024  Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024

Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024  Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024

Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024  Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024

Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024