U.S. tax changes tint 4Q loss at TransAct

Mar 06, 2018 Newsdesk Industry Talk, Latest News, World

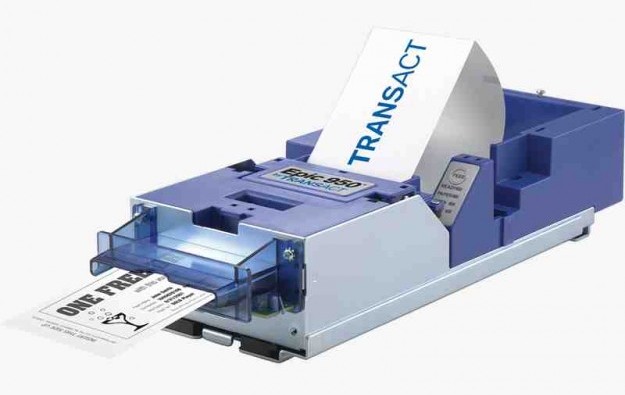

Transact Technologies Inc, a supplier of casino gaming machine ticket printers and other products for consumer transactions, moved to a fourth-quarter loss on operating income that fell 22 percent.

Such quarterly loss was US$412,000 compared to net income of nearly US$1.4 million in the prior-year quarter; on operating income that slipped to US$1.5 million, from US$1.9 million previously, the company announced on Monday to Nasdaq.

Fourth-quarter gross margin improved by 6 percentage points year-on-year, to 50.2 percent, which TransAct said was the second consecutive quarter a new company record had been set for that indicator.

The 2017 fourth-quarter results included the impact of a US$1.3-million charge to income tax expense “related to the revaluation of deferred tax assets” resulting from tax reform in the United States, the firm stated.

Total revenue in the three months to December 31 stood at approximately US$13.2 million, down 3.0 percent from the prior-year period. Casino and gaming equipment sales during the reporting period slipped 8.3 percent to US$4.4 million, from US$4.8 million a year earlier.

For full-year 2017, group net income contracted 11.2 percent year-on-year, to US$3.2 million, from nearly US$3.6 million in 2016. For the calendar year, casino and gaming sales slipped 11.4 percent, to just under US$18.6 million, from nearly US$21.0 million in 2016.

Bart Shuldman, chairman and chief executive of TransAct, said in a statement included in the earnings announcement: “The fourth quarter concluded a year of strong operating performance and growing momentum as we delivered our highest-ever quarterly gross profit margin and established a foundation for 2018 growth.”

“Our casino and gaming business is… positioned to grow, as demonstrated by the 34 percent year-over year-increase in domestic casino and gaming printer sales in the fourth quarter of 2017,” he added.

The group’s fourth-quarter net loss per common share on a basic and diluted basis was US$0.06, compared to a profit of US$0.18 in each case for the prior-year quarter. For full-year 2017, profit per common share on a basic and diluted basis was US$0.43 and US$0.42 respectively, compared to a profit of US$0.48 and US$0.47 in full-year 2016.

On Monday, TransAct’s board authorised a programme to repurchase up to US$5-million of its outstanding common stock on the open market, between now and December 31, 2019.

Related articles

-

TransAct-Table Trac slot management...

TransAct-Table Trac slot management...Aug 30, 2024

-

TransAct 2Q sales top US$11mln, loss...

TransAct 2Q sales top US$11mln, loss...Aug 09, 2024

More news

-

Added disruption in 4Q amid Londoner...

Added disruption in 4Q amid Londoner...Oct 24, 2024

-

45pct of Mega Fortris US$23mln IPO for...

45pct of Mega Fortris US$23mln IPO for...Oct 24, 2024

Latest News

Oct 24, 2024

Macau casino operator Sands China Ltd says it will have more rooms out of commission during the fourth quarter this year amid the ongoing development work at The Londoner Macao resort (pictured)....Sign up to our FREE Newsletter

(Click here for more)

(Click here for more)

Pick of the Day

”Our new programme [for the fourth tower of Marina Bay Sands] creates a full-scale integrated resort development with a full suite of amenities, including gaming capacity”

Patrick Dumont

President and chief operating officer of Las Vegas Sands

Most Popular

Genting Singapore to wind up seven Japan units October 21, 2024

Genting Singapore to wind up seven Japan units October 21, 2024  Macau, Cambodia most feel loss of China VIP play: S&P October 22, 2024

Macau, Cambodia most feel loss of China VIP play: S&P October 22, 2024  LVS flags US$8bln investment in Marina Bay Sands IR2 October 24, 2024

LVS flags US$8bln investment in Marina Bay Sands IR2 October 24, 2024  Mohegan Inspire mass table drop tripled since open: firm October 23, 2024

Mohegan Inspire mass table drop tripled since open: firm October 23, 2024  Sands China announces new US$4.2bln credit facility October 23, 2024

Sands China announces new US$4.2bln credit facility October 23, 2024