Macau ops make progress on non-casino ents: scholar

Jun 16, 2023 Newsdesk Latest News, Macau, Top of the deck

Industry competition as well as the policy directives of the Macau government, are driving the city’s casino concessionaires to increase the amount and variety of their non-gaming entertainment, suggests a local gaming scholar in comments to GGRAsia. A particular focus is appealing to families and younger consumers from China and the rest of Asia, says Carlos Siu Lam.

“With the keen competition among the casino operators, Macau has performed better than expected in its non-gaming segment,” stated Mr Siu, associate professor at the Centre for Gaming and Tourism Studies of Macao Polytechnic University.

There has been an uptick in the volume and variety of announced events since the ending of most Covid-19 -related travel restrictions at the start of the calendar year. They include arena-based or banquet-hall concerts by artists drawn from across the region; including the neighbouring city of Hong Kong, as well as South Korea, Taiwan, and mainland China.

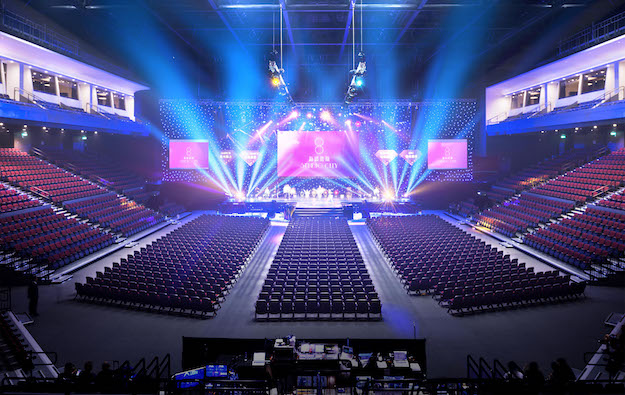

Though Mr Siu noted that at this stage of the post-pandemic recovery, most events are one-off, or short runs. An example of the latter is two sold-out concerts in May by K-pop girl band Blackpink, held at the new Galaxy Arena at Galaxy Macau, the flagship Cotai resort of Macau operator Galaxy Entertainment Group Ltd.

Actual residencies involving “big shows” require “substantial investment”, that need time to recoup the outlay.

He gave as an example the House of Dancing Water, that had been a long-standing resident show at Melco Resorts and Entertainment Ltd’s City of Dreams complex in Cotai, but which was suspended ultimately in June 2020 amid the Covid-19 pandemic. The company had mentioned in December last year – when it outlined its non-gaming effort planned for its new 10-year concession that began on January 1 – that it intended to revive the spectacle in 2024.

Nonetheless, the entertainment schedules across the six-operator sector indicated “an increased number of shows or activities… catering to different groups of patrons,” suggested the scholar.

Sands China Ltd said it would, from this year onward, deepen its collaboration with Star CM Holdings Ltd, a major mainland-China based creator and operator of variety shows.

Hong Kong-listed AGTech Holdings Ltd said in February it had a three-year “strategic agreement” with a unit of Galaxy Entertainment, for organisation of cultural and entertainment-related events in Macau. The arrangement is also said to feature a partnership with Beijing Damai Cultural Media Development Co Ltd, and Alibaba Pictures Group Ltd.

Earlier this week, Galaxy Entertainment also announced a three-year “strategic partnership” with the TME Live brand, for entertainment events at the 16,000-seat Galaxy Arena. It added that the partnership was likely to involve “in-venue” and “online” events, “including top-tier concert tours, music festivals, [and] music ceremonies.”

Entertainment for Asian patrons

A research paper by Mr Siu published last year, called “Macao’s Non-gaming Entertainment, Culture and City Branding”, looked at the work being done by the industry to broaden its consumer appeal, and featured interviews with entertainment-planning managers from some of the city’s gaming concessionaires.

Some interviewees mentioned the challenge of ensuring entertainment content had sufficient consumer appeal relative to the investment made, and cited the variety of consumer tastes across a country as large as China.

Mr Siu’s paper said this had resulted in a “prudent” approach among the gaming operators, so that they preferred to book only the most popular singers and other entertainers from either mainland China, Hong Kong, or Taiwan. That way, the operators could guarantee a “certain level” of ticket demand from the artists’ “fans”.

Mr Siu highlighted to GGRAsia that some experiments in entertainment content made by Macau gaming operators – during the previous concession period that ended last year – had not fared so well in terms of consistent consumer appeal.

He said examples included the Cirque de Soleil show Zaia, that ran from 2008 to 2012 at the Venetian Macao, a venue of Sands China; and the Franco Dragone-created Taboo cabaret, hosted at City of Dreams from April 2013, and which closed in March 2016. The Cirque du Soleil and Dragone brands have for some years been successful staples of the entertainment scene in the United States’ casino hub Las Vegas, in Nevada.

But Mr Siu noted to GGRAsia: “Such Western-style entertainment may not… match the preference of the Chinese. Besides, these shows and projects require much investment, so they were short-lived from the viewpoint of the cost and benefit analysis.”

With the right programming however, resident shows could still work, given Macau’s “large tourist base” drawn from China and elswhere in Asia, said Mr Siu.

He suggested a move into more non-gaming entertainment would also address a new reality in the Macau casino sector: that the available consumer market is “less excessive” in its gambling spend, than some of the customers previously hosted by the operators.

That might mean that the packaging of non-gaming entertainment with gambling, could still be of benefit to the earnings of the casino department of a resort.

“Casino operators may incentivise patrons,” by bringing in “some of their favourite singers to their properties,” Mr Siu remarked to GGRAsia.

Related articles

-

Macau average 5-star 1H rate 96pct of...

Macau average 5-star 1H rate 96pct of...Jul 22, 2024

-

3 Macau ops had back office IT hit by...

3 Macau ops had back office IT hit by...Jul 22, 2024

More news

-

Donaco EBITDA up y-o-y to above US$4mln...

Donaco EBITDA up y-o-y to above US$4mln...Jul 26, 2024

-

HK listed Palasino upgrades Czech...

HK listed Palasino upgrades Czech...Jul 26, 2024

Latest News

Jul 26, 2024

Border-casino operator Donaco International Ltd has achieved a 164.17-percent year-on-year increase in its latest quarterly group earnings before interest, taxation, depreciation and amortisation...Sign up to our FREE Newsletter

(Click here for more)

(Click here for more)

Pick of the Day

”We’ve got more traction outside of Macau at the moment. But Macau’s going be a bigger focus for us”

David Punter

Regional representative at Konami Australia

Most Popular

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024

Sheraton brand to exit Londoner Macao, to be Londoner Grand July 25, 2024  Macau regulator probes unlicensed gaming agents July 24, 2024

Macau regulator probes unlicensed gaming agents July 24, 2024  Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024

Philippines gives 20k aliens in POGOs 60 days to leave July 25, 2024  Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024

Philippines-listed DigiPlus says not affected by POGO ban July 24, 2024  Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024

Sands China 2Q EBITDA down q-o-q amid low hold, renovation July 25, 2024